Wealth managers already have to contend with a lot these days to remain competitive in their business. Now the potential of artificial intelligence increasingly presents threats and opportunities to the industry. But for all the change that is occurring — from technology to the rapid democratization of wealth — the core of wealth management comes down to one thing: serving the client’s purpose for their wealth.

That purpose is what differentiates wealth from being a mere collection of assets to being a tool clients can use to gain financial security for their loved ones and build a legacy in business and philanthropy.

“The fundamental objective for a wealth manager is to understand the real purpose of wealth,” David Durlacher, chief executive officer of Julius Baer International said in a recent interview. From his position at Julius Baer, Durlacher has an exceptional view of the industry. The firm, founded more than 130 years ago, has offices in more than 30 countries and has more than $500 billion in assets under management as of the end of June 2023.

With wealth spread across such distinct geographies as Zurich to Mumbai, one might think that the fundamentals of wealth management would differ but Julius Baer’s universal, purpose-driven approach is the foundation of its success.

“Our problem as a wealth manager is that we tend to focus too much on the things that clients see as hygiene factors,” Durlacher said, referring to things like execution efficiency, technology, and investment performance. He doesn’t dismiss their importance, he just notes that businesses and clients alike need to have a different starting point. “Clients, like businesses, need to ask bigger questions than just how much money they want to make over a particular timeframe. Questions like: what is my purpose? What is my impact upon the world? What is my impact on my community, my impact on my family? What is the fundamental purpose of my wealth?”

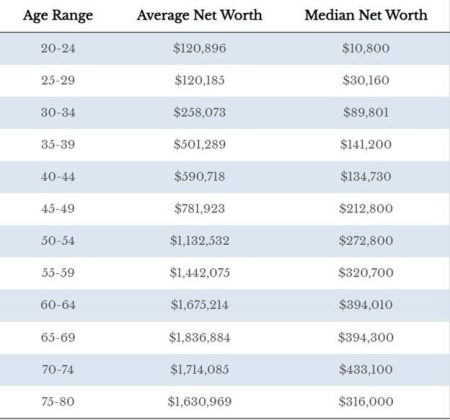

This framework has become increasingly important in recent years as the profile of the wealthy has shifted. For billionaires under 50 years old, it is more likely that their wealth came from tech or finance, according to data firm Altrata[1]. For those above 50, fortunes are more generally made in banking, industrials, or conglomerates. However, the younger — and growing — cohort of billionaires have different ways of thinking about their wealth than prior generations.

“The simple fact remains that there is a new generation with new aspirations for what the world will look like and their place in that world,” Durlacher said. “If the wealth management industry is to survive it, it needs to be able to speak the same language and understand the same mindset.”

For Durlacher that means a marriage of Intelligence Quotient (IQ)and Emotional Quotient (EQ). Much of the IQ portion – the interpretation of the markets and investments — could be delivered better in the future through technology and AI. EQ is what could make us relevant because it is the essence of humanity and something that can never be replaced by technology.”

“At times I fear we could lose the heart of our industry,” Durlacher explained. What he instead envisions is for the wealth management industry to flourish, it needs to engage and scale its humanity. “Improving processes and investing in tech is crucial, but we also need to inspire and engage our clients and those who work with them; to provoke creativity, to generate innovation of mind, and to ask the bigger picture questions like ‘what’s it all for?’ Clients are not looking for knowledge or analysis alone. They’re looking for inspiration.”

One way that wealth managers could meet this need is by embracing technology. Some have worried that the entrance of artificial intelligence or even robo-advisors in the last decade would dehumanize the industry. But instead, many are coming to realize that it could actually make advisors more valuable. No longer encumbered by the administrative aspects of financial planning — data gathering, scheduling, etc — they are free to do analysis and client outreach, which is what clients depend on. More importantly, it frees up advisors to focus on helping their clients identify the purpose of their wealth and what they want their legacy to be.

“How can technology help advisors? I think you can do it in three ways, one of which is to free up client-facing people to be able to face clients more rather than being consumed by administrative tasks. The second is to gather together deeper and richer insights into clients, and the third is to help you to communicate smarter,” Durlacher said.

Putting all of that together ultimately gets to the core of wealth management — helping clients identify their purpose.

[1]

Read the full article here