Retirement marks the time to savor the rewards of your hard work and cherish the freedom to pursue your passions. However, a comfortable retirement requires careful planning and sufficient savings to support your desired lifestyle. Many aspire to achieve a $2 million retirement fund, but is this feasible in America?

Understanding Your Retirement Savings Goal

Before diving into your $2 million retirement quest, it’s vital to comprehend how much you’ll need to save. Your retirement savings goal hinges on various factors, including your current age, desired retirement age, projected lifespan, and expected retirement expenses.

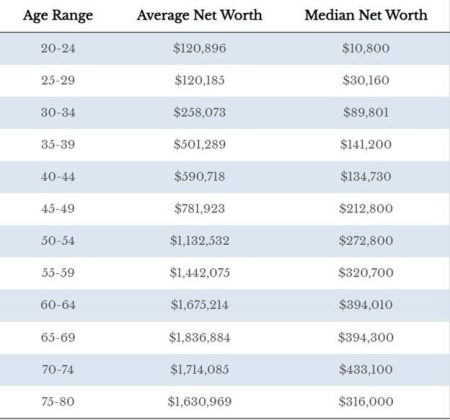

A common rule of thumb is aiming for a retirement income of around 80% of your pre-retirement income. For instance, if you currently earn $100,000 per year, a retirement income of $80,000 annually should be your target. Assuming you plan to retire at age 65 and expect to live until 85, you’ll need to save approximately $2 million to maintain your retirement lifestyle.

However, this is a general guideline, and individual needs may vary based on lifestyle and other considerations. Consider working with a financial advisor to determine your specific retirement savings goal.

Factors Impacting Retirement Savings

Several factors can make it more challenging to reach your $2 million retirement goal. The escalating costs of healthcare, in particular, can have a significant impact as your medical needs increase with age. Additionally, many Americans are underinsured or face high deductibles, making essential medical care unaffordable.

Inflation is another factor to consider. Over time, the cost of goods and services tends to rise, potentially diminishing the purchasing power of your savings.

Moreover, unexpected expenses can throw a wrench into your retirement savings plan. Early retirement due to health issues or job loss, as well as unforeseen home repairs or other expenditures, can deplete your savings.

Strategies For Reaching Your $2 Million Retirement

The key to maximizing your retirement savings is to start early. The sooner you begin saving, the more time your money has to grow through compound interest. For instance, if you begin saving $500 per month at age 25 and earn an average annual return of 7%, you’ll amass over $1.2 million by age 65. However, if you wait until age 35 to start saving, you’ll need to set aside over $1,000 per month to reach the same goal.

Many employers offer retirement plans, such as 401(k) plans or pension plans, that can boost your savings. These plans often come with tax benefits and employer contributions. Take full advantage of your employer’s retirement plan by contributing as much as you can. In 2021, the maximum contribution limit for a 401(k) plan is $19,500, and individuals over age 50 can make catch-up contributions of up to $6,500.

Diversifying your investments can help maximize your retirement savings. While investing carries risks, it also offers the potential for higher returns than traditional savings accounts. Developing a balanced investment portfolio and working with a financial advisor can help you navigate the investment landscape effectively.

Next Steps Towards Your $2 Million Retirement

Achieving a $2 million retirement goal is feasible with careful planning and the right strategies. Starting early, maximizing employer plans, investing wisely, and diversifying with real estate can set you on the path to building the wealth needed for your desired retirement lifestyle. Collaborating with a financial advisor ensures a personalized plan tailored to your goals. With the right approach, you can embark on a comfortable and secure retirement journey in America.

Read the full article here