Key takeaways

- Jobless claims rose for the fourth week in a row, but continuing claims are still well under the spring peak

- Headline inflation for July came in at 3.2%, meeting analyst forecasts and primarily driven by shelter costs

- The stock markets reacted positively to both pieces of news, but the bond market was volatile due to the Treasury sell-off

The weekly unemployment benefit claims rate has hit its highest point in a month, but the data still isn’t trending in the right direction for the Fed to cool its jets on inflation. Speaking of which, the July inflation rate was a little warmer, but nothing that prompted any concerns from the markets.

It was a turbulent day for bonds for a different reason, while economists are beginning to wonder how the Fed’s monetary tightening efforts will handle upcoming headwinds that have the potential power to change the course. We’ve got the latest on what the facts and figures are, as well as how the markets fared.

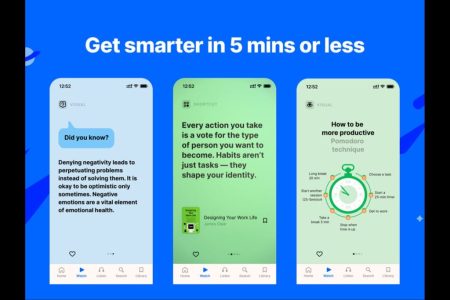

Inflation waves can be rough, but Q.ai’s Inflation Protection Kit is your financial surfboard. Navigating the currents, its AI scans and forecasts the best assets to help you maintain your purchasing power and protect your investments.

With inflation-busting holdings like TIPS, precious metals and commodities, the AI helper sifts through the data, forecasts where the upside could lie and switches around the holding as needed. It’s all in the name of helping you maximize your portfolio gains in the face of high inflation.

Download Q.ai today for access to AI-powered investment strategies.

What’s happening with jobless claims?

Jobless claims for the week ending August 5 came in at 248,000, up 21,000 from the week before and the second increase in a row. Economists had been anticipating 230,000 new claims.

However, continuing claims painted a different picture: at 1.68 million, this was below the consensus estimate of 1.7 million from analysts. Continuing jobless claims remain well below the high of 1.86 million from mid-April.

The labor market has been a critical barometer of how the battle against inflation is going for the Fed. This latest data suggests that the jobs market, which has remained surprisingly resilient in the face of rising interest rates, is still a problem for the central bank – and could sustain interest rates at higher levels for longer.

Is there any other new data on inflation?

The latest consumer price index (CPI) report snapped the months-long streak of declining inflation figures, but the gain was easily quantified. Headline inflation peaked at 3.2%, up 0.2% from the previous month. Core inflation, which strips out volatile food and energy prices, was also 0.2% up month-on-month.

That’s pretty much where the bad news ends, especially considering the figures were in line with estimates. Even though the core inflation figure increased, it was the smallest back-to-back gain in two years. It’s also at its lowest level since the fall of 2021. Translation: nothing to be worried about this month.

While rising inflation looks bad, it’s important to contextualize the results. The Bureau of Labor Statistics confirmed shelter, or housing and rental prices, accounted for 90% of the increase. This is one of the slowest sectors to see monetary tightening policy take effect, so the Fed thinks these prices will fall in the coming months.

We’re also expecting the consumer confidence and producer price index (PPI) reports today, which will give further insight into the economy’s health next to these inflation and jobs figures.

What was the market reaction?

The combined glass-half-full approach to the jobs data and looking at the upside with the CPI report affected the markets differently.

Stocks swung higher at the news, which is no surprise given the markets have shrugged off the uncertainty thus far. As trading opened on Thursday, the S&P 500 climbed 0.9%, the tech-heavy Nasdaq was up 1.1% and the Dow Jones Industrial Average gained 1%. Those gains retreated throughout the day, but the indexes still closed up and snapped a losing streak.

Bonds had a volatile Thursday. The inflation data initially pushed Treasury yields lower, but the Treasury’s budget deficit is weighing on this corner of the market. A $23 billion auction of 30-year Treasury notes sold for a yield of 4.189%, the highest rate since 2011, yet demand was still low. 10-year yields dropped as low as 3.94% before climbing back to 4.11%.

The U.S. dollar also made gains for the fourth week in a row, lending further credence to market optimism that the Fed will hold on interest rate increases.

What happens next with interest rates?

The question on everyone’s minds is whether interest rates have now peaked or if we’re set for more eye-watering increases that further impact businesses, the housing market and consumer spending.

The CME FedWatch tool, which tracks market sentiment on what will happen at future Fed meetings, jumped to 91% certainty of a pause in interest rates for September. The chances of November’s meeting bringing an interest rate hike also dropped to 29%.

It’s entirely possible we might not see another rate hike for the rest of the year, but several inflation increases in a row might start to dampen that enthusiasm. Pair it with some of the headwinds approaching, such as student loan repayments resuming in the fall and increased insurance premiums, and we may be singing a different tune a few months down the line.

It takes time for all parts of the economy to feel the full impact of rate rises, so while there isn’t much to be concerned about right now, the Fed will most likely continue its data-driven approach.

The bottom line

Inflation is a challenging genie to get back into the bottle. With so many different parts of the economy forming the overall picture, the Fed probably feels like it’s playing Whack-A-Mole with trying to keep everything in line long enough for inflation to drop within the Fed’s target 2% range.

A slight rise is a normal part of inflation, but a continued increase or stubborn hold are both potential problems for the Fed. The markets will be watching closely to see how the next leg of battling inflation faces its fresh challenges for the rest of the year.

The Fed can’t yet take its foot off the pedal with monetary tightening. Beat inflation at its own game with Q.ai’s Inflation Protection Kit. Powered by AI, it’s always looking for inflation-resistant assets that stand tall against rising prices, helping ensure your investments are consistently optimized.

With the assistance of a sophisticated AI algorithm, it sieves through the data, selects the assets that can withstand inflation’s pressure, and reshuffles holdings to help protect and grow your wealth.

Download Q.ai today for access to AI-powered investment strategies.

Read the full article here