In a victory for borrowers and for the Biden administration, a federal district court has dismissed a legal challenge to a critical initiative that will result in billions of dollars in student loan forgiveness.

Borrowers are now starting to receive discharges. And the Education Department is poised to implement additional debt relief under the program in the coming months.

Here’s what latest legal battle means for borrowers.

Court Rejects Legal Challenge To Student Loan Forgiveness Under Biden Adjustment

On Monday, a federal district court in Michigan tossed a lawsuit challenging the IDR Account Adjustment, a Biden administration initiative designed to provide borrowers with credit toward student loan forgiveness.

Income-driven repayment plans allow borrowers to repay their federal student loans based on formulas applied to their income and family size. Any remaining balance can be forgiven after 2o or 25 years, depending on the plan, or in as little as 10 years for borrowers who work in nonprofit or public jobs and qualify for Public Service Loan Forgiveness. But the IDR and PSLF programs had systematic problems for years due to complicated rules, poor administration by loan servicers, and inadequate oversight by the federal government, blocking many borrowers from receiving the debt relief promised by law.

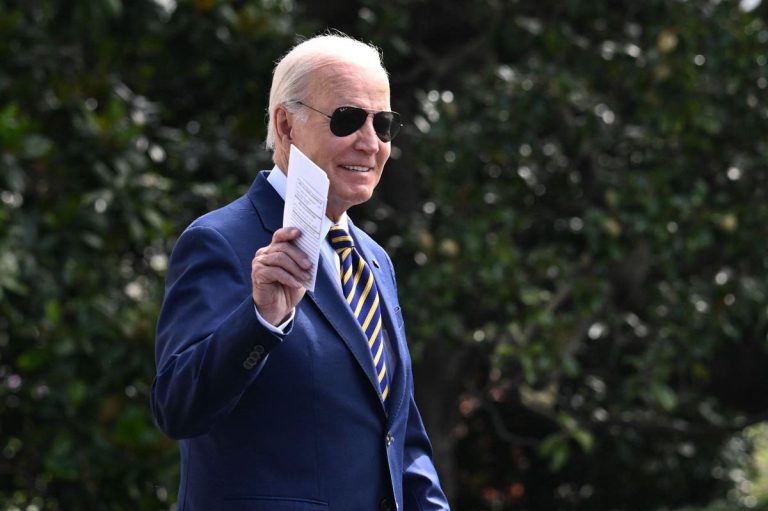

President Biden announced the IDR Account Adjustment last year as a fix to these longstanding issues. Under the adjustment, the Education Department will be able to retroactively credit borrowers with time toward loan forgiveness under IDR and PSLF. Many past periods of repayment, and some prior periods of deferment and forbearance, can count. Some borrowers will receive enough credit to reach the threshold for student loan forgiveness, while others will be able to advance their progress and shorten their remaining time in repayment.

Two conservative legal groups filed a last-minute legal challenge to the adjustment, seeking to block student loan forgiveness and the retroactive PSLF and IDR credit provided by the program. But on Monday, a federal judge rejected their challenge, concluding that their arguments that the adjustment would harm the organizations’ ability to recruit and retain employees were “vague and conclusory.” The court dismissed the case on standing grounds.

Education Department Is Implementing Student Loan Forgiveness In First Batch Of Relief

With the legal challenge dismissed, the Education Department is moving forward in implementing student loan forgiveness for the first batch of eligible borrowers under the IDR Account Adjustment.

“For years, student loan borrowers haven’t received forgiveness under their Income-Driven Repayment plans despite making payments for over 20 years. I’m determined to fix it. Today, thanks to my Administration’s actions, 804,000 borrowers will start to see their debt cancelled,” said President Biden in a statement on Monday.

Those borrowers were notified by the Education Department in July that they qualified for student loan forgiveness under the IDR Account Adjustment. The department now appears to be in the process of discharging those debts.

Next Wave Of Student Loan Forgiveness Coming

The 804,000 borrowers now receiving student loan forgiveness under the IDR Account Adjustment represent just the first wave of borrowers potentially eligible for relief.

“The first group of eligible borrowers were informed by ED on July 14, 2023, that they have loans that qualified for forgiveness,” says the Education Department in an update on its website. “ED will continue to identify and notify borrowers who reach the necessary forgiveness threshold of 240 or 300 months’ worth of qualifying payments, depending on the repayment plan and type of loan. We will send these notifications out every two months until next year, at which point all borrowers who are not yet eligible for forgiveness will have their payment counts updated.”

That means the next batch of borrowers who qualify for student loan forgiveness under the adjustment could be notified in September, two months after the first group of borrowers received their approval emails.

“Your student loan servicer(s) will notify you directly after your forgiveness is processed. Make sure to keep your contact information up-to-date with your servicer and on StudentAid.gov,” says the department.

Borrowers who receive credit under the IDR Account Adjustment, but fall short of the threshold for loan forgiveness, should “be able to see your exact payment counts for IDR in the future,” likely in 2024.

Next Steps In Legal Challenge To Student Loan Forgiveness

The Plaintiffs in the legal challenge disagree with the court’s ruling and are “reviewing our legal options,” according to a statement by their attorney given to the Washington Post. That means they could be looking to appeal the dismissal.

In the meantime, the Biden administration is working to develop a “Plan B” to replace the separate, broader one-time student loan forgiveness plan that was struck down by the Supreme Court in June. Details on that replacement plan are not expected to become clear for at least several more months.

Further Student Loan Forgiveness Reading

Student Loan Forgiveness Just Got Easier For These Borrowers

5 Student Loan Forgiveness Updates As Payments Resume In A Matter Of Weeks

Student Loan Forgiveness May Begin This Week Under Adjustment, But Uncertainty Looms

Critical Student Loan Repayment And Forgiveness Deadlines Loom In August — And Beyond

Read the full article here