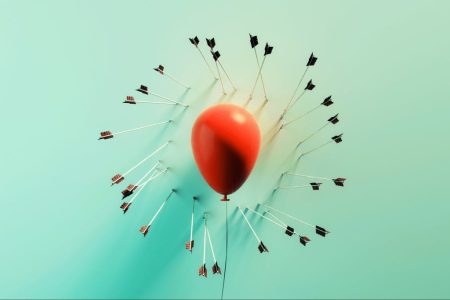

Artificial intelligence can help you beat the stock market, but not in the way most investors think it will.

The key appears to be investing in those companies that manufacture and support AI’s infrastructure: the chips and networks that enable AI’s machine learning.

In contrast, investors looking to AI to help construct winning portfolios are likely to be disappointed.

Consider the period since late last year — Nov. 30, 2022 to be exact — when Chat GPT debuted and AI quickly became the latest Wall Street fad. Through the end of July, Nvidia

NVDA,

—whose computer chips are integral to many AI applications — gained 176%, compared to just 4.8% over the same eight-month period for the Eurekahedge AI Hedge Fund Index.

This index “is designed to provide a broad measure of the performance of underlying hedge fund managers who utilize artificial intelligence and machine learning theory in their trading processes.” The average AI-informed hedge fund even lagged the S&P 500’s

SPX

total return over this period, which was a gain of 13.7%.

It’s unfair to focus just on Nvidia, since it’s become the darling of Wall Street’s obsession with AI. But the average company in the AI space has also outperformed the Eurekahedge index. For example, the iShares Robotics and Artificial Intelligence Multisector ETF

IRBO

has gained more than 30% over this eight-month period, for example, more than doubling the stock market’s return and far outstripping the hedge-fund index.

It’s also unfair to focus on just the period since Chat GPT’s launch, since eight months hardly constitutes a significant track record. But the average AI-informed hedge fund hasn’t made more money than the broad U.S. market over the longer term either, as you can see from the accompanying chart.

The stock market is the ultimate AI tool

I will go out on a limb and predict that AI approaches will not, on average, do any better relative to the market than they have since 2009. That’s for a couple of reasons. The first is that, to the extent AI has theoretical value as a stock picker, it will quickly become widely used. In the process, its theoretical advantage will get discounted away.

Not everyone can be above average, after all. The percentage of advisers and strategies beating the market over the long term will not change after AI becomes widely adopted. As we all know, that percentage is tiny.

If you have any doubt, read the seminal article from more than 30 years ago by Nobel laureate William Sharpe, entitled “The Arithmetic of Active Management.” He argued that “after costs, the return on the average actively managed dollar will be less than the return” of the overall market, and that this conclusion depends “only on the laws of addition, subtraction, multiplication and division. Nothing else is required.”

I hope it goes without saying that AI does not suspend mathematical laws.

“ AI can’t know more than the market knows. The best it can hope to do is to match the market over the long term. ”

My second reason to predict that AI approaches won’t beat the market is that the market already discounts virtually all the publicly available information that would otherwise be used to train machine-learning models. So, in principle, AI can’t know more than the market knows. The best it can hope to do is to match the market over the long term.

Think about the potential exogenous global events that could influence the stock market, of which the following is a tiny sample:

- The political fallout of criminal investigations of a former U.S. president’s efforts to overturn an election, which some believe could lead to a civil war

- The war in Ukraine, which could escalate into nuclear war

- The possibility that climate change will lead to a huge increase in the number of weather-related catastrophes

If you were training an AI model, what historical information would you feed into the model to help it predict how these factors would play out? Once that question is answered, you face an even bigger obstacle: What makes you think this information isn’t already discounted in the market?

By no means are my arguments the final word on this subject; I fully expect many of you to object. If so, I offer you the following bet: The S&P 500 over the next decade will outperform the average return of a representative sample of AI-generated stock portfolios. How many of you are willing to take the opposite side of that bet?

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: This is what tech companies, from Amazon to Apple, just told investors about AI

Plus: Why the AI stock frenzy looks disturbingly like the PC and dot-com booms — and busts

Read the full article here