The federal government, initially established to serve the people, has veered off course. While Americans are going about their business, it is business as usual in Washington. In short, the politicians who were elected to represent us are seemingly more interested in pandering to special interest groups and their own political party. Meanwhile, the national debt continues to rise with no sign of abating. Thus, the country is on a collision course with financial reality. How long until the American dream becomes the American nightmare? How long will Americans tolerate the reckless spending, which permeates Washington?

Surplus-Deficit

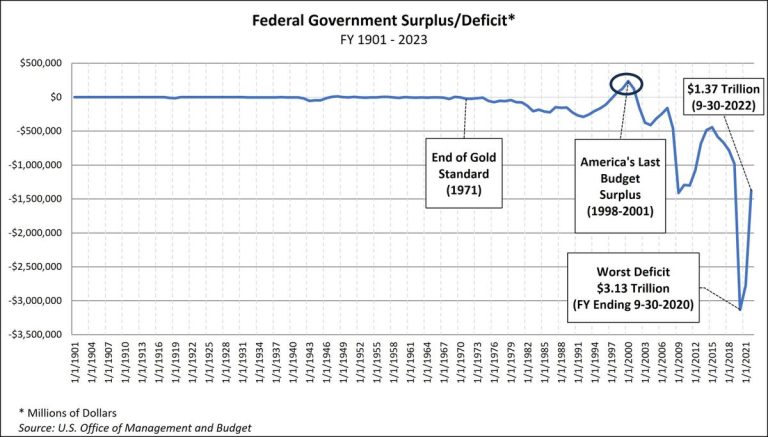

When you spend more than you collect, you have a deficit and must borrow to meet expenses. The last time the federal government had a budget surplus was 1998-2001 when President Clinton occupied the White House and republicans controlled both sides of Congress. In recent years the deficits have exploded and the national debt, which now stands at more than $32 trillion, continues to soar. If America were a business, it would have filed for bankruptcy long ago. The following chart reveals the federal government’s fiscal year surplus/deficit from 1901 to 2023. Note how the end of the gold standard marked the beginning of recurring deficits. Without a gold standard, there is no need to back each dollar with gold and the government can essentially print as much currency as it desires. As noted in the chart, the worst deficit was over $3.13 trillion at the beginning of COVID, and the most recent deficit was over $1.37 trillion as of fiscal year ending 9-30-2022. Remember, when there is a deficit, the government must borrow to meet expenses, which increases the national debt.

The National Debt

The national debt is fast approaching $33 trillion and is projected to exceed $44 trillion by 2027, only four short years from now. Despite this, Congress continues to spend excessively, while each party blames the other. How long can America continue its present course? This depends on the government’s ability to meet its financial obligations along with the willingness of Congress to curtail spending. What could happen when things implode? This is a scenario where civil unrest could escalate and crime flourish. In essence, if the financial fabric of America is badly shaken, society as we know it could experience a radical change. We already have civil unrest from many at the lower end of the social-economic ladder.

Will Congress reduce spending before it’s too late? It seems unlikely as doing so could alienate millions of voters. You see, politicians have been redistributing tax dollars and borrowed monies for years to garner support. Once elected, the goal is to get reelected. While many programs are necessary, there is a massive amount of wasteful spending which desperately needs to be addressed. While millions of Americans are suffering, Washington spends billions of dollars unnecessarily. Shouldn’t we use some of this money to improve the lives of U.S. citizens?

The national debt has increased at a much faster rate in recent years. The chart below shows the level of the national debt from 1966 to the present. Notice the sharp increase after 2008 and an even sharper increase beginning in 2020. Again, our trillion-dollar deficits are simply added to the debt.

The Bank of International Settlements (BIS), the bank of 63 central banks (including the U.S. Fed), in a 2011 research paper has concluded when a government’s debt-to-GDP ratio exceeds 85%, economic activity is slowed. The U.S. ratio is now close to 120%.

Rahm Emanuel, current Ambassador to Japan, former member of Congress (2003-2009), Chief of Staff under President Obama (2009-2010), and mayor of Chicago (2011-2019), once said, “You never let a crisis go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” In other words, politicians should seize the opportunity to increase government spending during a crisis. Unfortunately for taxpayers, when the federal government expands, even after the crisis ends, it rarely returns to its pre-crisis size.

Will politicians begin acting responsibly with the finances of the United States? There have been a few members of Congress who seem to get it, but they’ve been drowned out by the majority who prefer the status quo. Excessive and wasteful spending continues, enormous deficits remain, and the debt is poised to rise even further. Term limits might solve the problem, but asking members of Congress to vote to limit their time in Washington is a bit like asking the fox to guard the henhouse. Neither are practical.

Read the full article here