Never have so many economists changed their minds so quickly.

Buried in the latest Economic Policy Survey released this week by the National Association for Business Economics was a virtual U-turn in the outlook for the people generally regarded as the smartest and best at evaluating the economy.

If the broad change in thinking is right, better days — and fewer bad days — lie ahead, but any sudden change in thinking gets observers wondering if the lemmings are heading for a cliff.

Nearly three-quarters of the economists polled for NABE’s August survey agree that current monetary policy is “about right,” and nearly 70% had some level of confidence that the Federal Reserve will be able to achieve a soft landing.

Read: Recession at least a year away, economists now say

In the March 2023 Economic Policy Survey, that same percentage of surveyed economists reported being “not very confident” or “not at all confident” that a soft landing could be achieved.

“Whenever economists are no longer predicting gloom and doom, you should always take it as a good sign,” said Mervin Jebaraj, director of the Center for Business and Economic Research at the University of Arkansas’ Sam M. Walton College of Business in an interview on my podcast, “Money Life with Chuck Jaffe.”

“The big difference between March and now is that, maybe in March, … there was some disbelief that the economy hadn’t slowed yet and now, at this point, we now believe that this is actually possible.”

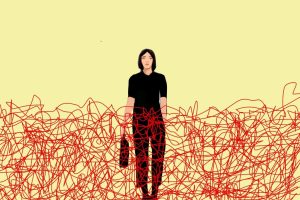

When investors get giddy in unison, market observers get nervous. It’s not just the old saw about being greedy when others are fearful and fearful when they get greedy, it’s that the timing of the investment herd is notoriously suspect.

Most investors wait until the market proves something to them before getting in, meaning they miss much of the uptick and catch most of the downturn that occurs after peak euphoria. It’s never surprising when individual investors get whipsawed by their emotions and sentiment turns around on a dime.

But economists are supposed to be cool and unemotional. They are, to borrow from the Fed, data-dependent and are not easily moved.

While I mostly disagree with the old quip about how all the world’s economists laid end-to-end still couldn’t reach a conclusion — it’s a good line but economist opinions tend to run in packs and sometimes jump to conclusions — a quick 180-degree turn in forecasts is highly unusual, especially at a time when there are so many classic indicators still saying that there’s trouble ahead.

The yield curve remains inverted — meaning short-term interest rates are higher than longer-duration rates — and that has never failed to be a precursor to a recession, albeit always requiring a good long lead time.

Likewise, the Leading Economic Index from The Conference Board fell for the 16th straight month in July; there’s no denying that tighter monetary policy, elevated prices, harder-to-get credit, and reduced government spending historically put a damper on the economy, although it often requires at least 18 months or more of those behaviors to trigger a recession.

To reach the conclusion that the economy can minimize or avoid recession and that the Fed can pull off a soft landing, economists appear to believe that those long-term indicators of economic health don’t matter so much anymore.

Two things are fueling that thinking: 1) consumer spending boosted by a strong job market, and 2) the indicators are still tainted from the COVID-19 pandemic.

“The yield curve doesn’t predict recessions, it predicts a process that leads to recession,” said Edward Yardeni, president and chief investment strategist at Yardeni Research, in another recent interview on my show. “Maybe it’s just due to be wrong; just because something has been spot-on right consistently doesn’t mean it’s guaranteed.”

Yardeni noted that the traditional process following a yield-curve inversion is that no one wants to buy long-term paper because short-term bonds have a higher payoff; that effect is muted now “if you don’t think the two-year is going to stay at these levels,” and current calls for Fed rate cuts in 2024 suggest that investors may want to lock in rates for longer.

Yardeni said he thinks the economy is experiencing “rolling recessions,” downturns that have gone through economic sectors like housing, goods and commercial real estate that have been localized enough to not ruin the whole enchilada.

Interestingly, Yardeni said he believes there are simultaneous rolling recoveries happening in retail sales and now a rebounding housing market.

Robert Frick, corporate economist at Navy Federal Credit Union, said in another interview on the show: “We’ve never really been in danger, in hindsight, of recession. It’s all about the consumer and now the consumer is getting stronger.” Frick noted that he is focusing on consumer-driven numbers and ignoring the yield curve and leading indicators, which he feels are irrelevant in current conditions.

Of course, none of this means that the economy will completely avoid recession, rather that economists expect a downturn to be brief and muted, and that anything that feels rougher than the hoped-for soft landing won’t be felt for six months or more.

Besides, flip a few numbers and get some modest hint at policy change from Jerome Powell and the economists could set off in another direction completely.

That’s not the behavior they’re known for but given the way they’re responding to current economic conditions, no one should be surprised if they do a do-si-do and spin around the next time the music changes.

Read the full article here