Allstate is among the top five holdings of the Invesco KBW Property & Casualty Insurance ETF.

Justin Sullivan/Getty Images

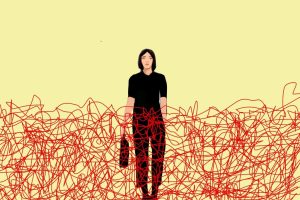

Hurricanes, thunderstorms, and wildfires have thrust insurance companies into the spotlight, and while it may seem catastrophic weather would be a nightmare for them, it has long been the opposite. The worse things get, the more insurers respond with higher rates and stingier coverage, pushing up profits.

“There’s an aphorism in insurance for insurance investing that bad news is good news,” says Meyer Shields, an analyst at Keefe, Bruyette & Woods.

Now may be the time to consider adding property and casualty insurers to your portfolio.

Carriers have been able to boost premium rates, taking in revenue that they will invest to cover future losses. Many have also pulled out of disaster-prone areas, including California and Florida, where they couldn’t charge high enough rates to make profits. Moreover, analysts say the industry is, for the most part, very well capitalized and can handle a coming storm of claims.

Investors can always buy shares of individual companies. Earlier this year, for example, Barron’s recommended

Chubb

(ticker: CB), the global leader in property and casualty insurance, as a stock pick. But for those looking for a cheap alternative that offers broad exposure across P&C insurers, one exchange-traded fund fits the bill: the Invesco

KBW Property & Casualty Insurance ETF

(KBWP).

Rene Reyna, head of thematic and specialty product strategy at Invesco, says the fund, which has $151.6 million in assets, offers investors pure-play exposure with its portfolio of 24 companies—carriers and reinsurance companies, which provide insurance to insurers—across commercial and personal lines.

The passive strategy tracks the KBW Nasdaq Property & Casualty Index and is rebalanced quarterly. The fund’s top five holdings are:

American International Group

(AIG),

Chubb,

Progressive

(PGR),

Allstate

(ALL), and

Travelers

(TRV).

Ryan Jackson, manager research analyst for passive strategies at

Morningstar

Research Services, said the fund targets a specific corner of the market and investors need to set reasonable expectations for what it is going to deliver.

The ETF has a five-star, bronze medalist rating from Morningstar, and is down about 4% this year. But it has delivered solid performance versus its Morningstar financial services benchmark since it launched in 2010—the ETF ranks in the top quartile over one, five, and 10 years, with total returns of 5.64%, 7.75%, and 11.19%, respectively.

Jackson says the fund charges a reasonable fee of 0.35%—what he calls run-of- the-mill for a sector industry ETF.

“Generally speaking, these more niche strategies are going to charge a little bit higher fees than something like a broadly diversified U.S. equity portfolio,” he said.

He likes that the fund tracks a market capitalization weighted index of companies.

“We have a favorable view on market-cap weighting, the idea being that, especially in a market like the U.S. that’s highly efficient and prices tend to do a good job of reflecting the intrinsic value of each stock, you’re basically allowing the market to express its view on which stocks are most valuable,” Jackson said.

One caution, however, is that with two dozen stocks in the portfolio, the ETF is fairly concentrated. As such, the fund should be a “complementary investment to something a lot more diversified as your core allocation,” Jackson said.

Write to Lauren Foster at [email protected]

Read the full article here