JPMorgan Chase notified the Treasury Department of more than $1 billion in suspicious transactions by Jeffrey Epstein dating back 16 years after the notorious sex predator killed himself in 2019, a lawyer for the U.S. Virgin Islands told a federal judge at a hearing Thursday, reports said.

“Epstein’s entire business with JPMorgan and JPMorgan’s entire business with Epstein was human trafficking,” Mimi Liu, an attorney for the Virgin Islands told Judge Jed Rakoff in U.S. District Court in Manhattan, according to The Daily Beast.

Liu cited the bank’s notification to the Treasury Department as she argued that Rakoff should issue a summary judgment against JPMorgan, which is being sued by the Virgin Islands government for allegedly facilitating sex trafficking by Epstein of young women when he was a customer of the bank from 1998 through 2013.

The attorney, referring to a $9 million block of transfers to women and suspicious withdrawals from Epstein’s accounts at JPMorgan, said it related to “facilitating” more than 20,000 sexual acts, the Daily Beast reported, given Epstein’s habit of paying several hundred dollars for each sexual encounter.

“JPMorgan was a full-service bank for Jeffrey Epstein’s sex trafficking,” Liu said at the hearing, Bloomberg reported.

“The only reason that JPMorgan after 16 years reported the $1 billion in suspicious transactions was because he was arrested and then he was dead,” said Liu, according to Bloomberg.

She has accused the bank of continuing to do business with Epstein for years despite repeated red flags internally and his 2008 guilty plea to a Florida sex crime, the report said.

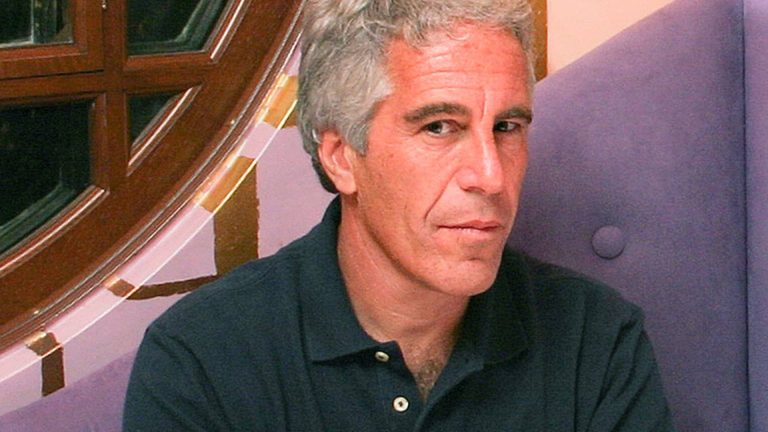

Epstein, 66, killed himself in a New York jail in August 2019, a month after he was arrested on federal child sex trafficking charges. In addition to a residence in Manhattan, Epstein owned a private island in the Virgin Islands, where he was accused of sexually abusing women.

A lawyer for JPMorgan, which denies wrongdoing in the case, pushed back against the Virgin Islands claims that it should be found liable for abetting Epstein’s abuse of women.

The Virgin Islands is seeking at least $190 million in damages in the case, which will go to trial on Oct. 23 if Rakoff does not grant summary judgment to either side.

The bank’s lawyer, Felicia Ellsworth, told Rakoff that the Virgin Islands had presented “not a scintilla” of evidence that JPMorgan violated laws about sex trafficking, according to The Daily Beast.

Ellsworth also argued that the Virgin Islands lacked the legal standing to sue the bank. JPMorgan has said the American territory can only sue to vindicate the rights of residents, and that there is no proof that any of Epstein’s victims were residents of the Virgin Islands.

“There is hotly disputed testimony and evidence,” Ellsworth told Rakoff, according to Bloomberg.

A JPMorgan spokeswoman declined to comment to CNBC about the Virgin Islands’ claims that the bank notified the Treasury Department of more than a $1 billion in suspicious transactions by Epstein.

JPMorgan in July agreed to pay $290 million in a settlement with victims of Epstein to resolve a similar lawsuit filed by one of the accusers in Manhattan federal court.

In June, Deutsche Bank, which had taken Epstein on as a client after he was forced out by JPMorgan in 2013, agreed to pay $75 million to Epstein’s victims to settle a third suit in the same court.

Read the full article here