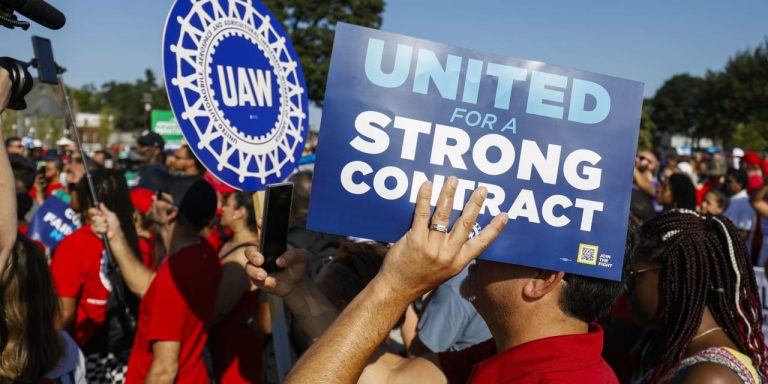

A strike or new contract will raise labor costs for General Motors, Ford, and Stellantis, but even nonunion automakers such as Rivian and Tesla are facing increasing wages.

Bill Pugliano/Getty Images

There are seven days left before the United Auto Workers’ labor deal with the Detroit-Three automakers expires. After Sept. 14, a strike is almost assured.

Some on Wall Street are worried about the costs of a work stoppage.

Strikes are scary, but wages don’t rise in a vacuum. Investors should remember that nonunion automakers always look at what unionized workers are making.

“Let’s be clear: this is a potential nightmare situation for GM and Ford as both 313 stalwarts are in the early stages of a massive electric-vehicle transformation path for the next decade that will define future success,” wrote Wedbush analyst Dan Ives in a Wednesday report.

The 313 area code is for Detroit where

General Motors

(ticker: GM) and

Ford Motor

(F) are based, and where Chrysler parent

Stellantis

(STLA) has roots, too.

Ives believes the timing is terrible. GM and Ford are ramping up EV production to catch up with

Tesla

(TSLA), and a stoppage will leave the legacy auto makers with more ground to make up.

“We spent time in Detroit a few weeks ago and sense a very nervous time across the auto industry as there is a lot riding on these negotiations and with the recent UPS union deal sealed this puts more pressure on the UAW leadership to deliver a big win,” Ives wrote.

United Parcel Service

(UPS) recently signed a new deal with the Teamsters that includes wage increases of roughly 5% to 6% a year on average for the coming five years. How wages will increase exactly isn’t really calculable, it’s a rough guide based on available data.

Investors should expect wages to rise for the UAW. Inflation has averaged closer to 4% over the life of the existing contract while wages rose closer to 2% a year on average. That gap is one reason these negotiations are so tough.

“We think a strike by the UAW’s approximately 150,000 members starting in mid-September is highly probable,” wrote CFRA analyst Garrett Nelson in a Tuesday report. “In fact, we think a strike could potentially last for several weeks.”

Nelson adds that new UAW President Shawn Fain is looking to make his mark, asking for more than 40% wage increases over the life of the contract.

Higher labor costs could disadvantage GM, Ford, and Stellantis relative to nonunion automakers such as

Rivian Automotive

(RIVN) and Tesla. Still, wages are rising across the U.S., and Tesla and others have to raise wages to lower the risk of unionization. Tesla CEO Elon Musk has even invited the UAW to hold a union vote in California “at their convenience.”

To be sure, it isn’t all doom and gloom. GM experienced a roughly monthlong strike in 2019. The stoppage and labor agreement didn’t cripple the company or its relative profitability.

What’s more, not every Wall Street analyst is worried. Morgan Stanley’s Adam Jonas and BofA Securities’ John Murphy both wrote recently that any dip due to labor fears is a buying opportunity in automaker stocks. Both believe that the stocks tend to recover after labor fears push them down in the weeks leading up to contract expiration.

Fears appear to be pushing stocks down in the 2023 labor negotiation season. GM, Ford, and Stellantis shares are down about 10%, 7%, and 7%, respectively, over the past month. The

S&P 500

is about flat while the

Dow Jones Industrial Average

is down about 2%.

The stocks might recover after an agreement, but there is no guarantee the agreement will be struck before Sept. 14 at midnight.

The next week or so is going to be interesting.

Write to Al Root at [email protected]

Read the full article here