The Federal Reserve left rates unchanged at its latest meeting this week, but its aggressive rate-hiking campaign over the past 16 months has left borrowing rates for consumers higher than they have been in years.

Here is a look at where interest rates are hovering for home mortgages, credit cards and auto loans:

Home loans

According to the latest data from Freddie Mac, the average rate for a 30-year, fixed-rate mortgage is 7.18%, the highest level in two decades and more than three points higher than a year ago. Pre-pandemic, the average for the benchmark rate was at 3.9%.

FED SKIPS AN INTEREST RATE HIKE, BUT HIGH MORTGAGE RATES COULD BE HERE TO STAY

Credit cards

A report from the Fed released earlier this month shows the average credit card interest rate as of the second quarter was 20.68%, which is more than 5% higher than it was the same quarter in 2022.

AVERAGE MONTHLY MORTGAGE PAYMENT AT NEAR ALL-TIME HIGH

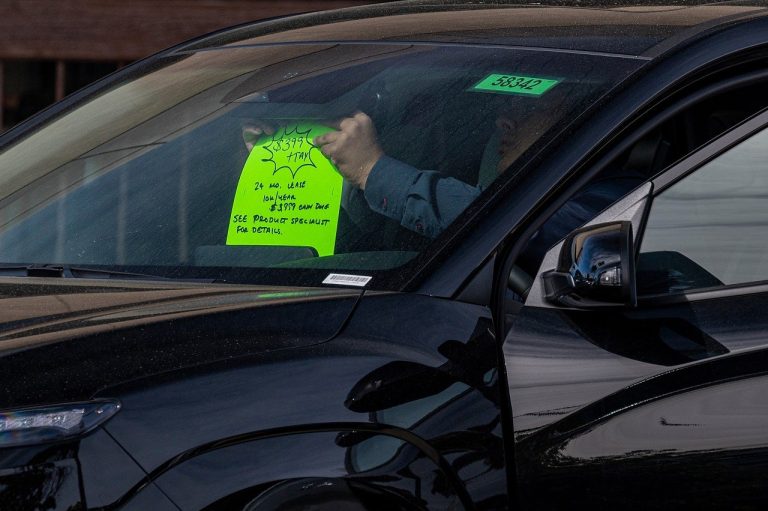

Auto loans

According to a recent report from Market Watch, the latest data from credit scoring agency Experian shows the average auto loan for a new vehicle was 6.63% in the first quarter and for used vehicles, buyers took on average interest rates of 11.38%.

The Fed hinted Wednesday that it could impose another rate hike this year.

FOX Business’ Megan Henney contributed to this report.

Read the full article here