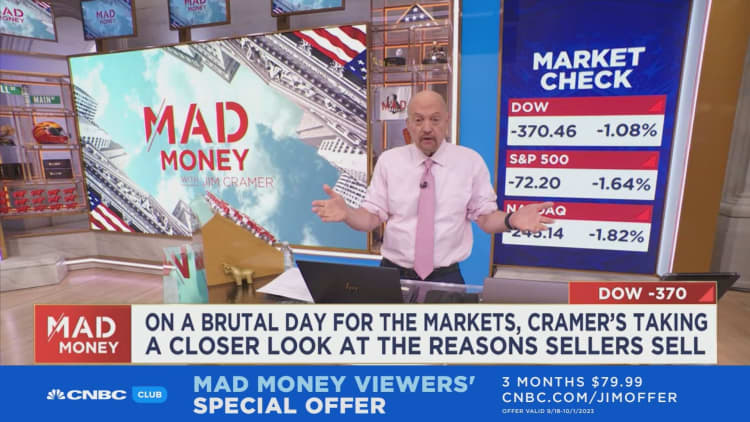

CNBC’s Jim Cramer on Thursday proposed six reasons why investors are selling and bringing the market down.

“Some of them make sense, others don’t. But what you have to realize is that every time the stock market goes down, these reasons to sell all become less relevant,” Cramer said. “That’s what lower prices do. They take points like these into account.”

- Interest rates: Cramer said rates can be a good reason to sell. If investors think inflation is coming down as rates go higher, they may want to sell stocks and instead enter the bond market, picking up long-term Treasurys to get a risk-free return.

- Macroeconomic weakness: “Macro” headwinds add risk to companies trying to close deals and may create a “difficult adjustment” for investors, Cramer said. But he also said stocks will come down to compensate for this weakness, and once it’s priced in, there will be a return to normalcy.

- Fear of giving up on gains: Cramer said investors may sell to lock in gains they’ve made earlier in the year. He said this tactic may make sense for money managers who are graded on an annual basis but not necessarily for individual investors. According to Cramer, investors selling because of fear translates to selling low and buying high.

- Federal Reserve: Investors may feel wary because the Fed isn’t “sounding an all clear,” Cramer said. Such amorphous fears are no reason to sell, he added. Cramer encouraged investors to buy stocks that do well in inflation and sell them once inflation eases.

- Political climate: Cramer acknowledged that the Democratic and Republican parties have an “insanely toxic relationship,” but he thinks that dysfunction is baked into the market.

- Strikes: Cramer noted that Wall Street may be scared of a potential ripple effect caused by United Auto Workers strike, but he doesn’t think it will happen because most American workers do not belong to unions.

Cramer’s bottom line?

“The Fed can’t upend the rally because there isn’t a rally. Higher rates won’t send stocks lower because they’re already down. That’s how you have to think about things like the stock market,” he said. “Otherwise, you know what? There really isn’t a level where it feels safe to own stocks other than at the top, when nobody’s worried about anything. That’s not investing, though. That’s called stupidity.”

Read the full article here