JPMorgan Chase said Tuesday it will pay $75 million to settle a lawsuit by the U.S. Virgin Islands alleging that the huge American bank facilitated and benefited from sex trafficking of young women by its longtime customer Jeffrey Epstein.

JPMorgan did not admit any wrongdoing in the settlement, which will give $55 million to Virgin Islands charities and the American territory’s anti-trafficking efforts.

The remaining $20 million will cover attorneys’ fees incurred by the Virgin Islands as part of the litigation in federal court in New York.

The Virgin Islands said the deal “includes several substantial commitments by JPMorgan Chase to identify, report, and cut off support for potential human trafficking, including establishing and implementing comprehensive policies and procedures.”

The territory said that $10 million of the money received would be used to create a fund to provide mental health services for Epstein’s victims.

JPMorgan also said Tuesday that it had reached a settlement with Jes Staley, a former executive at the bank who had been friends with Epstein, to resolve claims by JPMorgan that he was responsible for any civil damages and costs associated with Epstein-related litigation.

The terms of the agreement with Staley are confidential.

JPMorgan said that it “deeply regrets” its association with Epstein, who was a client from 1998 until 2013.

Virgin Islands Attorney General Ariel Smith said the agreement settles what was the first enforcement action against a bank for facilitating and profiting from human trafficking.

“As part of the settlement, JPMorgan has agreed to implement and maintain meaningful anti-trafficking measures, which will help prevent human trafficking in the future,” Smith said in a statement.

“This settlement is an historic victory for survivors and for state enforcement, and it should sound the alarm on Wall Street about banks’ responsibilities under the law to detect and prevent human trafficking.”

The deals come months after a separate $290 million settlement by JPMorgan with victims of the now-dead predator. That earlier deal ended a similar lawsuit by one of those victims in U.S. District Court in Manhattan.

As with that prior agreement, the new pacts let the bank avoid a trial on the Virgin Islands’ allegations in that same court, which was due to start Oct. 23.

The territory had said it would ask jurors at that trial to award it at least $190 million in damages from JPMorgan.

The Virgin Islands previously obtained a $105 million settlement from Epstein’s estate, and another $62.5 million from billionaire investor Leon Black to resolve potential claims related to Epstein.

JPMorgan CEO Jamie Dimon and other top bank executives had been questioned by lawyers for the Virgin Islands as part of its suit against the firm.

Related court filings and hearings have led to a stream of embarrassing headlines about the bank since the case was filed in late 2022, more than three years after Epstein killed himself in a Manhattan jail following his arrest on federal child sex trafficking charges.

The Virgin Islands claimed JPMorgan effectively ignored repeated red flags that Epstein was trafficking women to his private island in the territory because it wanted to retain his business and that of his wealthy and powerful friends.

Among those red flags was Epstein’s 2008 guilty plea in Florida to a state charge of soliciting sex from an underage girl, a conviction that led to a 13-month jail stint.

In late August, a JPMorgan attorney told Judge Jed Rakoff that after Epstein died, the bank notified the Treasury Department that it since had identified more than $1 billion in transactions related to “human trafficking” by him dating back 16 years.

But the bank also had alleged in court filings that the Virgin Islands was complicit in Epstein’s crimes, saying he gave high-ranking territory officials money, advice, and favors in exchange for their allowing him to traffick women there unhindered.

In a press release announcing the new agreement with the Virgin Islands, JPMorgan said it “believes this settlement is in the best interest of all parties, particularly for those who can benefit from efforts to combat human trafficking, and for survivors who suffer unimaginable abuse at the hands of these criminals.”

“While the settlement does not involve admissions of liability, the firm deeply regrets any association with this man, and would never have continued doing business with him if it believed he was using the bank in any way to commit his heinous crimes,” the statement said.

“The firm will continue to work with law enforcement to combat human trafficking and help to identify improper money movement into the global payments systems.”

JPMorgan said that under the deal it will pay $25 million to the Virgin Islands “to enhance the infrastructure and capabilities of law enforcement to prevent and combat human trafficking and other crimes in their territories.”

The bank said it will pay another $30 million “to support USVI charitable organizations whose work is aimed at addressing social ills, including fighting human trafficking and other sex crimes, and to support survivors on their paths to healing.”

With the remaining money going to attorneys’ fees, JPMorgan is paying the same amount, $75 million, that Deutsche Bank agreed to pay Epstein victims to settle a third Manhattan federal court lawsuit that alleged that bank facilitated his sex trafficking when he was a customer from 2013 through 2018.

Deutsche Bank had taken on Epstein as a customer after JPMorgan ended its relationship with him when Staley left the bank.

Epstein for years socialized with high-profile people such as former President Donald Trump and Bill Clinton, Britain’s Prince Andrew, and had business relationships with billionaires such as Black and former L. Brands CEO Les Wexner.

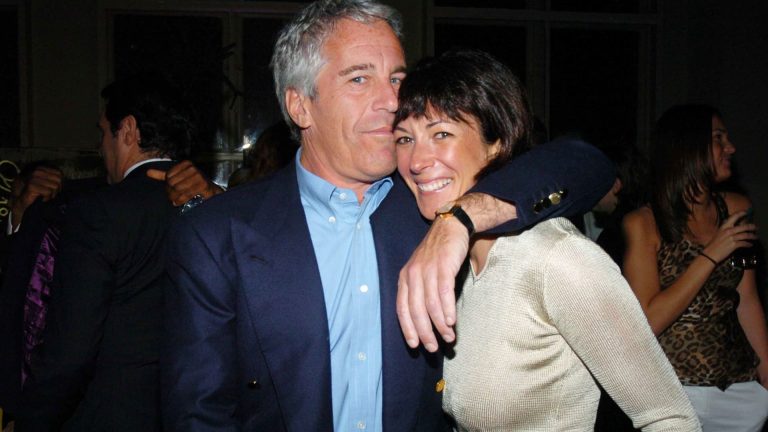

Ghislaine Maxwell, a British socialite who once was Epstein’s girlfriend, was convicted at a federal criminal trial in Manhattan in December 2021 of procuring underage girls to be sexually abused by him.

Maxwell later was sentenced to 20 years in prison.

Staley, the former JPMorgan executive has denied claims of wrongdoing, including an allegation that he sexually assaulted a woman identified as “Jane Doe,” whose class action suit led to the prior settlement with the bank.

In November 2021, Staley stepped down as CEO of Barclays after an investigation by British bank regulators into how he had characterized his relationship with Epstein.

This is breaking news. Check back for updates.

Read the full article here