Entrepreneur

An entrepreneurial mindset encourages individuals to view their personal finances as an opportunity for wealth creation and growth. This mindset emphasizes the importance of investing, whether in stocks, real estate, or other assets, to generate passive income and build wealth over time. That being said, developing your own foundational belief systems around your relationship with money is just as important as the financial vehicles themselves.

One should remember that financial literacy is a journey, and it requires consistent effort, practice and application of these foundational principles to enhance your understanding and improve your financial wellbeing. When it comes to money, adopting certain mindset philosophies can help shape your relationship with wealth creation and guide your decision-making. Here are five imperative viewpoints to consider:

1. View money as you would view a current

While the term “currency” is derived from the Latin word “currere,” which means “to run” or “to flow,” the concept of money flowing like a current is metaphorical rather than a literal representation. The term “currency” primarily refers to a system of money that is used as a medium of exchange for goods and services.

However, the metaphor of money flowing like a current can be used to describe the dynamic nature of money and its movement within an economy. Money circulates through various transactions, changing hands from one individual or entity to another. It flows through the economy, enabling economic activity and facilitating trade.

Similar to a current in a river, money is constantly in motion, connecting different participants in the economy. It can be earned, spent, invested, and transferred, creating a continuous cycle of transactions and economic interactions.

This metaphor highlights the importance of understanding and managing the flow of money. Just as currents in a river can be strong or weak, money can fluctuate in terms of its availability, value, and the speed at which it circulates. By being aware of this flow and managing their finances effectively, individuals and businesses can navigate the economic currents and make the most of their financial resources.

Related: We Need a Real Commitment to Mental Health at Work. Here’s How (and Why).

2- Don’t allow the limits of your past to have any bearing on your future

Embracing an abundance mindset involves believing that there are plentiful opportunities for wealth and success. It is about focusing on possibilities rather than limitations. With this mindset, you approach money with a positive and optimistic outlook, recognizing that there is enough for everyone and that your financial situation can improve through hard work, smart choices and abundance mindset-based actions.

Many emerging thought leaders have recently endorsed the ideology of “mindset monetization.” With these new, but logical shifts, countless case studies across the nation validate that financial empowerment begins with shifting your paradigm. And thus, by challenging the rigid, conservative “work, spend, save” 9-5 mindset and evolving from thinking like an entrepreneur rather than an employee, one can drastically uplevel their monetary milestones.

3. Pivot — don’t pause

The philosophy of financial independence centers around achieving freedom and control over your finances. It involves building a solid financial foundation that allows you to support yourself and pursue your desired lifestyle without being reliant on others. This mindset encourages you to take ownership of your financial situation, prioritize saving and investing, and develop multiple streams of income.

Take the pandemic, for example; leaders who adopted remote skills, studied macroeconomics and understood what sectors were poised for growth not only weathered the pandemic but significantly improved their business and personal growth.

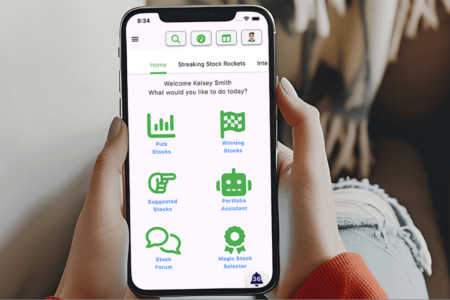

4. Continuous learning to stay updated on the latest financial trends

An entrepreneurial mindset prioritizes continuous learning and improvement. When it comes to financial literacy, this means actively seeking out resources, courses, and information to enhance your understanding of financial concepts, investment strategies and personal finance management. The post-Covid era has democratized online certifications from individual subject matter experts to academic institutions, so there is now a level playing field regardless of your geographical standpoint. Engaging in lifelong learning allows you to stay updated with the latest financial trends and adapt your financial strategies accordingly.

The philosophy of delayed gratification, in tandem with a commitment to learning, involves prioritizing long-term goals over immediate satisfaction. It requires resisting impulsive spending and prioritizing saving and investing for future financial security and goals. By delaying gratification, you can make wiser financial choices, avoid unnecessary debt, and accumulate wealth over time.

Related: The Financial Literacy Basics Entrepreneurs Need to Know

5. Practice mindful spending and asset allocation

Mindful spending involves being intentional and conscious about how you allocate your financial resources. It means aligning your spending with your values and priorities as well as the emerging, lucrative sectors that require attention. With this mindset, you take the time to evaluate your needs versus wants, track your expenses, and make deliberate decisions that reflect your financial goals. Mindful spending helps you avoid impulsive purchases, stay within your budget and make more conscious choices with your money.

Read the full article here