October has arrived and with it, the resumption of federal student loan payments.

This month, borrowers are expected to make their first mandatory payments on their loans in over three years since former President Donald Trump first enacted the forbearance on payments and interest in response to the Covid-19 pandemic. Interest started accruing on loans again on Sept. 1.

Your exact due date depends on your loan servicer. You should be notified of the amount you owe and the day by which you must pay at least 21 days before your payment is due. Your payment may be due later if you graduated recently, but you’ll still want to check with your loan servicer.

Log in to the Federal Student Aid website to find your servicer if you’re not sure who it is. Many borrowers had their loan servicers changed since they last made payments.

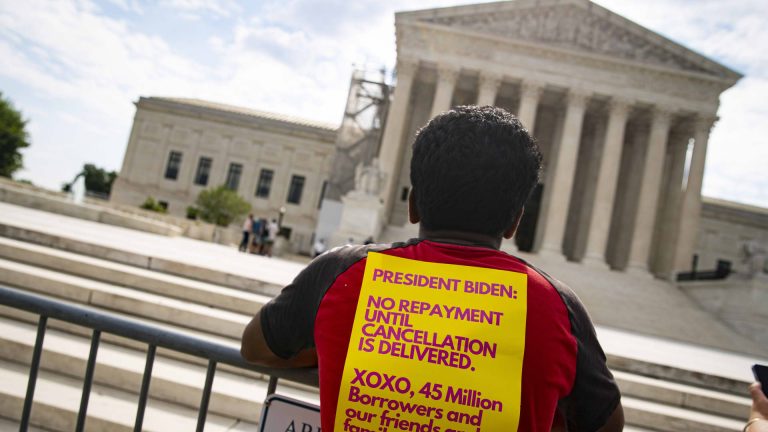

The Biden administration has taken a number of steps to assist borrowers in returning to repayment and to address the student debt crisis, including enacting numerous extensions to the payment pause.

Plus, over 3.4 million borrowers have had debt forgiven through the White House’s targeted relief efforts, such as fixes to Public Service Loan Forgiveness and income-driven repayment.

An ideal time for borrowers to resume paying back their student debt may not exist, but federal borrowers do have resources at their disposal to make returning to repayment as seamless as possible.

Here’s what you need to know.

What if I can’t afford my monthly payment?

One way the Biden administration is trying to help borrowers ease back into repayment is a yearlong on-ramp period during which late or missed payments will not be reported to credit bureaus.

However, interest will continue accruing on your loans, so it’s a good idea to pay what you can even if you can’t cover that full monthly payment.

You may be able to lower your monthly payment by applying for an income-driven repayment plan. The new Saving on an Affordable Education plan can bring your payment down to as low as $0 if you earn $15 an hour or less.

Is there still a chance my loans will be forgiven?

Americans aren’t very optimistic about student debt forgiveness in the near future. Just 28% think there will be an expansion of student loan forgiveness policies in the next year, the smallest share since President Joe Biden took office, according to the latest Survey of Consumer Expectations from the Federal Reserve.

Since the end of June when the Supreme Court struck down Biden’s plan to forgive up to $20,000 of debt per borrower, the administration has been charting a new path to forgiveness. It’s not clear how long the process will take, but the administration recently announced it will initially be prioritizing specific groups of borrowers.

There are still ways for borrowers to have their loans forgiven, including PSLF, which can erase your debt after 10 years in a public service career, and IDR, which forgives any remaining balance after 20 or 25 years of payments.

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Want to earn more and land your dream job? Join the free CNBC Make It: Your Money virtual event on Oct. 17 at 1 p.m. ET to learn how to level up your interview and negotiating skills, build your ideal career, boost your income and grow your wealth. Register for free today.

Read the full article here