Across the financial landscape—the industry, the media, the blogosphere, the DIY community—virtually all attention is paid to attaining and sustaining wealth. You’ll find more than you’ll ever need or want on saving, investing, and insuring, but then what?

It seems the presumption is that once you hit your number, or someone else’s, the game is over. Congratulations, you’ve won. But once you’re rich, how do you live a rich life?

How can you activate your wealth with a sense of purpose that brings meaning to your money?

The answer may be simpler than you expect, but before we get there, we need to address a couple of misconceptions about the word “wealth,” itself:

Misconception #1: “Rich” and “wealthy” are synonymous.

Words are awesome and powerful—and regularly misused and diluted. If we take a historical look at the words “money,” “riches,” and “wealth,” we find something interesting, challenging, and ultimately inspiring.

Money and riches have always meant pretty much what they mean today. Money was and is currency and riches an abundance thereof. But the original Greek (“ploutos”), Latin (“divitiae”), and Old English (“wela”) words from which wealth was derived reveal something much more nuanced, something that can’t be counted. It meant blessings, well-being, contentment. Enough.

This is why you can be rich but not wealthy, or wealthy but not rich.

Misconception #2: Wealth is only material.

The modern meaning of wealth falls especially short partly in its material limitation. Money and material resources are part of our wealth, but it’s so much more. Consider the following acronym, TIMER, that offers a fuller definition of wealth:

- Time

- Influence

- Money

- Energy

- Relationships

Click HERE for a fuller definition of each, but please note that money may be the least valuable of the five.

So how do we activate our wealth?

First, we must take stock of it. So, I’m curious: if you ranked your level of satisfaction on a scale of 1-10 regarding each of the above five components of wealth, with 10 being the best, how would you score yourself? Bonus question: Can you envision transferring a surplus in one category to a deficit in another?

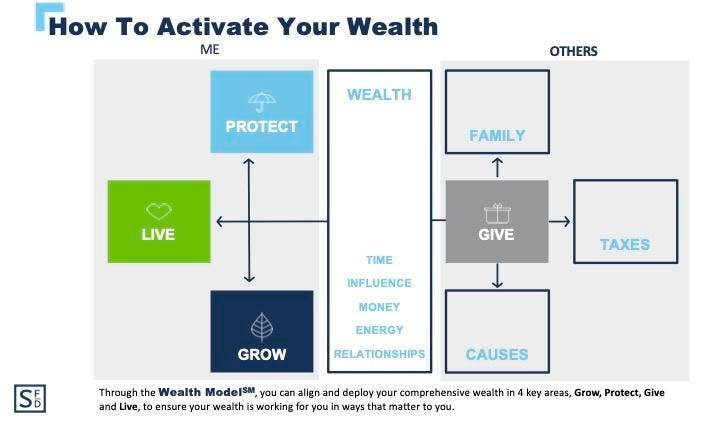

Then, we can activate our wealth by deploying it in one of four ways. Please consider this simple flow chart:

On the left side, you’ll see the three ways we can activate our wealth for our own worthy purposes. We can use it to:

- Grow our investments and income potential.

- Protect our family, lifestyle, and property.

- Live confidently with financial freedom.

On the right-hand side, you also see how we can activate our wealth for the benefit of others. We can:

- Give to the people and causes most important to us.

We could argue that, regardless of how generous we may count ourselves, we’re all givers through the convention of taxation. Indeed, the way the tax code is designed, it’s possible to reallocate a portion of one’s giving from your municipal, state, and federal beneficiaries to those people and causes of your choosing. All of this, of course, depends on your situation and your Certified Public Accountant’s analysis.

Don’t miss out on the power of the right-hand side of this flow chart. Years ago, I had the opportunity to interview the late Truett Cathy, the founder of Chick-fil-A, who had seen his vision of a better chicken sandwich mushroom into a fast-food empire—and wealth, by any measure, beyond his wildest imagination. I asked him, “With all of its troubles and trappings, is the pursuit of wealth worth it?”

“Only if you give it away,” was his immediate response.

Interestingly, Cathy had asked others known for personifying wealth what their definitions were, too, including the standard bearer for many, Warren Buffett. The Berkshire Hathaway

BRK.B

And lest we think this is a lesson exclusive to those who’ve made it onto some public net worth ranking list, please take another glance at our definition of wealth and the flow chart above. With our more accurate and expanded meaning, we can all count ourselves as wealthy and the stewards of far more than money. And if it is not money but time, influence, energy, or relationships where we have a surplus, could we not lend those to others with a deficit in those categories?

The real power of the wealth model is its customizability. It’s a framework, not a playbook. It’s yours to define each of the pillars and how they will work for you. And it’s through the activation of our wealth that all the effort to acquire it is made worthwhile.

Read the full article here