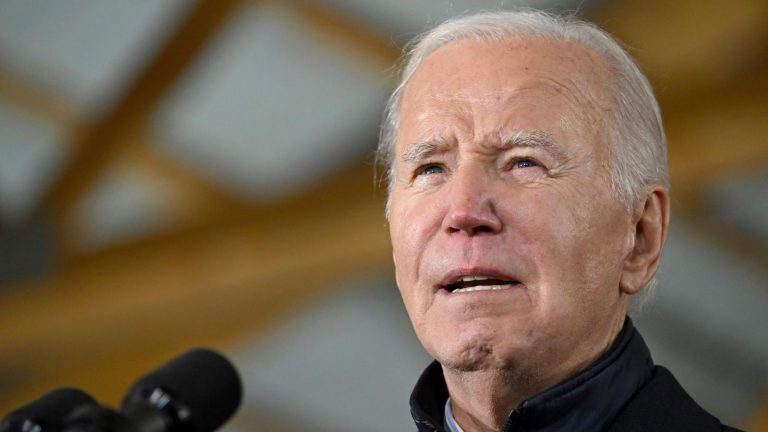

The Biden administration announced this week that nearly three million borrowers will be compensated for ongoing problems related to student loan servicing. As part of the compensation, the Education Department will waive interest, cancel payments, and credit borrowers with time toward student loan forgiveness programs.

Here’s what borrowers need to know.

Servicing Errors Impacting Payments And Student Loan Forgiveness

The federal student loan system is severely strained as nearly 40 million people simultaneously resume repayment after a 3.5 year hiatus. The Education Department and the Consumer Financial Protection Bureau have been fielding complaints from borrowers related to a variety of problems that are impacting their ability to repay their loans and remain on track for critical student loan forgiveness programs.

In a memo released this week, the Education Department detailed the scope of the issues:

- 2.5 million borrowers received untimely billing statements, or no billing statement at all. As a result, more than 830,000 borrowers missed a payment and became delinquent.

- 21,000 individuals have received incorrect monthly bills — some stating that they owed over $10,000 per month (and in a few cases, $100,000 per month).

- 16,000 people who qualify for student loan forgiveness under Borrower Defense to Repayment, and should not have to pay their loans while their discharge is processed, erroneously were put into repayment status and billed.

- 153,000 borrowers were not issued mandatory disclosure statements regarding their income-driven repayment plan terms, including revised monthly payment amounts under the Biden administration’s new SAVE plan.

The department also noted that borrowers are experiencing other problems including very long wait times when trying to reach their student loan servicer by phone. Only half of those who call their servicer are actually able to reach someone, according to the memo.

As a result of these issues, the department noted that borrowers entered delinquency, incurred late fees, or lost credit toward student loan forgiveness under income-driven repayment programs and Public Service Loan Forgiveness.

Borrowers Will Receive Compensation, Including Credit Toward Student Loan Forgiveness

The Education Department has ordered loan servicers to compensate impacted borrowers in several ways:

- Borrowers will be placed in an administrative forbearance while the issues are corrected. During this time, bills will be cancelled and no payments will be due.

- Those impacted may be eligible for refunds of any erroneous payments made.

- Individuals who incurred non-sufficient fund fees as a result of an automatic debit error can be reimbursed.

- IDR applications resulting in erroneous monthly payment amounts must be re-processed.

- Interest accrual will be waived while account issues are corrected.

- Borrowers will receive credit toward student loan forgiveness under IDR and PSLF “while their monthly payments are being recalculated.”

The department is ordering this relief “to ensure that affected borrowers are not harmed by these servicing errors identified during the Return to Repayment period.”

Student Loan Forgiveness Legal Authority

The Education Department’s memo notes that the Biden administration is relying on the Higher Education Act’s so-called compromise and settlement authority to implement this relief. Notably, this is the same legal authority that President Biden is using to establish a new student loan forgiveness plan. The new program may cover five broad categories of borrowers, including those who are experiencing financial hardships.

The department will be holding critical hearings on this new student loan forgiveness plan next week, with the rulemaking process continuing into December. Final regulations are expected to be released in 2024.

Further Student Loan Forgiveness Reading

Education Department Unveils Major Details On New Student Loan Forgiveness Plan

Didn’t Get A Student Loan Forgiveness Email? 7 Possible Reasons Why

5 Student Loan Forgiveness Updates As On-Ramp Begins And Problems Worsen

Check Your Email: 50,000 Borrowers Get Student Loan Forgiveness Notices, And Yes, They’re Real

Read the full article here