Tis the season…to be suspicious. Scamsters put the pedal to the metal on fraudulent pitches this time of year any number of ways and target older Americans and retirees.

Fake charity and shopping pitches usually dominate the top scams list. But there are plenty of safeguards you can take to avoid getting swindled.

“Bad actors are looking for ways to monetize activity and swindle you out of your hard earned cash,” says Dr. Stephanie Benoit-Kurtz, lead cybersecurity faculty at University of Phoenix College of Business and Information Technology. I asked Dr. Benoit-Kurtz on how you can protect yourself from the seasonal blizzard of scams:

- Don’t Respond to Suspicious Emails. ‘Bad actors are still using email to convince you to connect with them and click on links contained in the email. Do not take that bait. If you receive an email that has a huge sense of urgency and wants you to click on the link to log in to an account, make sure to reach out to the organization first through a phone number or email on their website to understand the validity and nature of the request. It is better to contact the company from their original website or phone number than to provide account information and login and password information from a bogus link.’

- Ignore Unsolicited Texts. Fraudsters are continuing to use text messages with links to get individuals to take action. Often, they pretend to be family, a friend, or an organization that maybe you do business with. Again, the sense of urgency is RIGHT NOW, and they are looking for you to wire a check, purchase and provide information from gift cards, or log in to an account from this link. Validate the requester before taking any action.

- Avoid Phone Calls and Voicemails. Believe it or not, bad actors are still using phone calls and voicemails to lure in unsuspecting victims. The caller generally is posing as someone from a place that is likely familiar. The IRS, and insurance companies, Apple

AAPL

AMZN

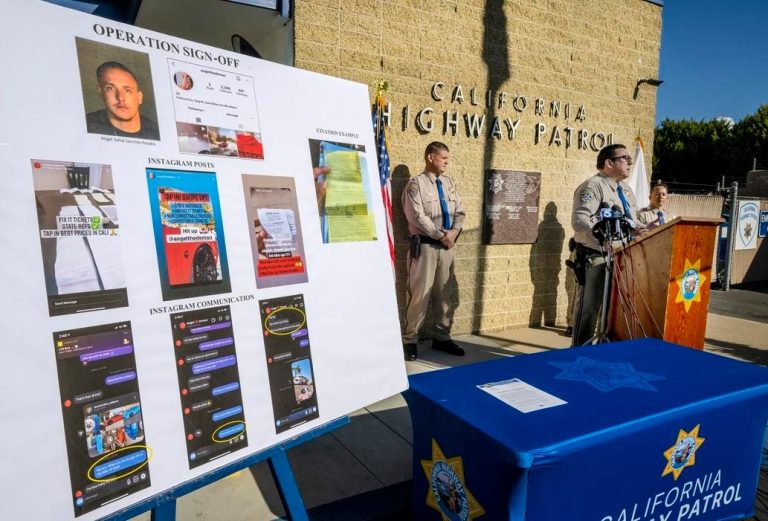

- Be Extra Cautious About Social Media. Scams in this area continue to grow. Scammers that connect with you and then say they are someone you know and need cash right away. Do not fall for it. If you receive a request for any money over social media, reach out to the person via a phone call to validate their situation. Never wire money or provide credit card information or gift cards on a social media platform.

According to the Federal Trade Commission (FTC), “scammers most often attempt to utilize an organization that you are familiar with. Medicare, IRS, Banking Institutions or Social Security and then leverage that conversation that compels you to take action,” Dr. Benoit-Kurtz has found.

There’s big money in scam solicitations: Consumers have been swindled out of more than $2.7 billion on scams just from social media alone. “Ensure you can 100% validate the requester before providing any information or funds,” Dr. Benoit-Kurtz adds.

In other words, enjoy the holidays and be merry, but also be extra wary.

Read the full article here