Over the weekend, Moody’s Investors Service, one of the three main credit rating agencies, signaled the US Sovereign Credit Rating could be subject to a future downgrade by changing the assigned Outlook from Neutral to Negative. The move follows a downgrade from Fitch Ratings on August 3, 2023.

For background, Moody’s, along with Standard and Poor’s (S&P) and Fitch Ratings, is one of three independent entities which assigns credit ratings to the debt of corporations, municipalities, and governments. Each rating agency has its own ratings scale and methodology. Moody’s remains the only rating agency that still assigns the United States the highest-possible rating, in this case Aaa. In addition to a rating, the agencies often issue an “Outlook”, which provides guidance on the how whether the intermediate term (12 months) view on the subject entity is trending positive, neutral, or negative. Ratings agencies may also assign an “on Watch” status, which is a notification that the subject investment could be upgraded or downgraded in the near-term (within 6 months).

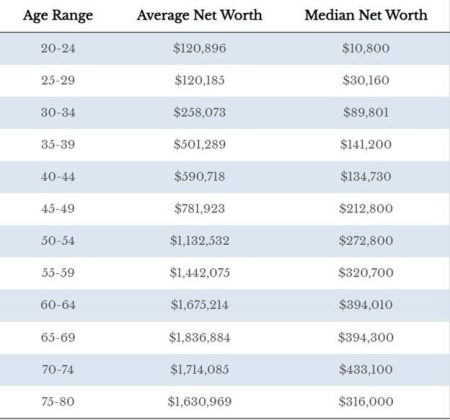

Exhibit: Recent US Sovereign Debt Ratings Changes

By revising the Outlook on US Sovereign debt to Negative, Moody’s is telling investors that the US’ pristine Aaa rating is in jeopardy. The reason – which should come to no one’s surprise – is out of control government spending amidst an alarmingly increasing debt burden. The explanation mirrors the sentiment of S&P and Fitch, with Moody’s noting “continued political polarization” in Congress raising the risk that lawmakers will be unable to fulfill their basic function of keeping the government running. Repeated debt ceiling showdowns and threats of government shutdowns, which we are presently amid yet again, support Moody’s argument that the government has fallen into a state of dysfunction.

Moody’s is also quite pessimistic on the near-term potential for Congress to get its act together, noting “any significant policy response that we might be able to see to this declining fiscal strength probably wouldn’t happen until 2025 because of the reality of the political calendar next year.” In other words, expect politicians to keep spending taxpayer money until they garner enough votes to keep their jobs beyond next November. Unfortunately, the odds are strongly in favor of Moody’s taking further action before 2024 elections conclude, which means the US could be about to lose its last remaining top-tier credit rating.

Read the full article here