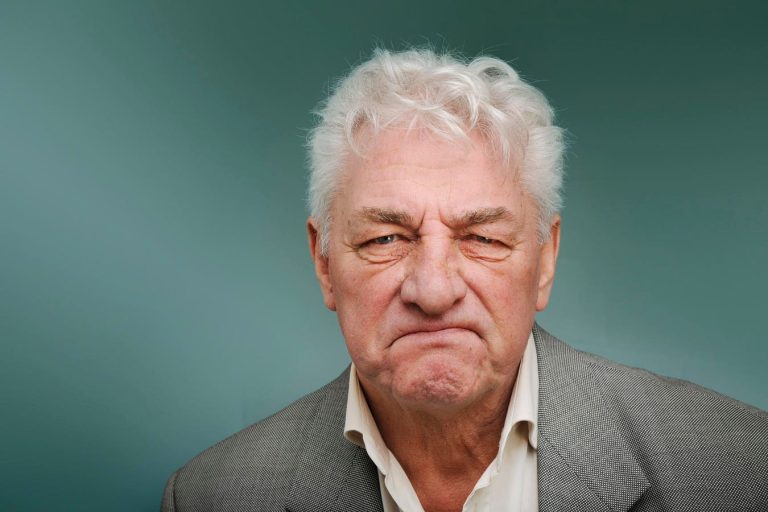

It is not surprising that we find mental illness across all age ranges. Being over 65 is no exception. Some adult children would probably say that things seem to get worse as their parent gets past retirement age. What we hear most often at AgingParents.com, where we consult with families of these elders, is that the senior in question is not getting any treatment for their mental health issues. They refuse medication and therapy.

The families who are struggling with this problem are not talking about a low level of wealth at stake. The aging parent who seems to be deteriorating mentally is sometimes the founder, CEO or has a controlling interest in a large corporation. There are vast sums at risk. The difficult elder is making rash decisions about how funds are being spent, or wants to undo years of success with changes to the business that look completely irrational to every other person and employee involved.

Unchecked Power

They worry. Will Dad trash decades of work with what he is now doing or threatening to do? Will he disinherit his kids if they disagree with his “crazy” plans? In these cases, the head of the company typically has the last word over the business’ finances. Usually, it is the male at the top of the power pyramid but sometimes it is not. Others in the family may be partners or participants in the business, but with less authority over the founder or owner with the mental health issues. No one ever planned to have to remove this person from the seat of authority. How could they do this if it is needed? It is very uncomfortable to even try to tackle this issue.

Authority To Remove Someone From Control

Sometimes, in a well-planned corporation, the legal documents specify what the Board of Directors can do if the person in control becomes disabled. The language in the articles of incorporation refer to what happens “in the event of death or disability” of the person primarily in charge or with the most voting power. Family who are concerned need to look carefully at those documents and get legal advice from someone outside the corporation about what it would take to remove the problematic person from authority. Using in-house attorneys can create a conflict of interest. This can be very tricky.

Typically, one must have data to use to determine what it means to become disabled. That normally means at least, a doctor’s report, sometimes two, stating that the person is impaired or disabled. But in many instances we have observed, the elder in question refuses to go to a doctor. They think they’re just fine and everyone else is out to get them. When an individual with a mental illness endangers a large business with a lot a risk, one cannot remove them from control without legal means. They’re not just going to step down because they are asked to do so. Getting a medical evaluation may take a lot of persuasion, and using the strength of loving relationships to get the person to a doctor for evaluation. If that seems unlikely, the legal documents that describe the business structure may offer guidance.

The Consequences Of Failing To Act

In too many cases we have consulted about, we see family being so intimidated by the aging parent facing a mental illness that they just don’t risk confronting the person. They hope that somehow Dad or whoever it is will get better or realize that it’s time to retire, or whatever other false hope they can muster. In those cases, the ill elder keeps making bad decisions, the business loses value and sometimes in the end, it fails altogether. It’s never a good idea to wait until a business entity is on the verge of collapse before deciding to try to sell it. When the family members involved do take action, it can turn things around and prevent massive financial losses.

The Team Effort That Can Succeed

In the few matters we have observed when family was able to get control over the business run by a person with a mental illness, it took effort by every involved person available. Sometimes the wife was instrumental in eventually persuading the husband with a mental illness to see a doctor, be evaluated and declared impaired by the physician. That, together with the board of directors who had a positive relationship with the elder in question, was enough to get the elder treatment for his mental illness or to get him to retire. It took months of effort and everyone working together in the successful cases. When adult children were involved, they had to get past their fear of the aging parent to act in his best interests, even if he made threats and got angry with them. The board of directors of the corporation, the family and legal counsel working together did succeed in some of these cases.

The Distinction Between Mental Illness And Cognitive Impairment

Mental illness and cognitive decline are not the same thing. Mental illness is treatable. For any reader who has had a family member facing a mental illness you may understand that medication together with talk therapy can make an enormous difference in the behavior a person with a mental illness presents. That is, if they take the medication prescribed, and attend therapy with a competent professional.

On the other hand, cognitive impairment, typically characterized by short term memory loss at first, often progresses with age. Some cognitively impaired people do go on to develop dementia. At this time, we do not have any drugs that can stop dementia. That is a different kind of problem from mental illness. There are clearer legal paths in estate planning documents to address dementia and how to remove someone from authority over the family finances.

Generally, it still takes a medical doctor to find the person incapacitated to remove them from the control over a business. When there is a lot at stake, family members need competent legal advice to find a way to save the business.

Double Whammy

We sometimes find both mental illness and cognitive impairment going on simultaneously in the person with authority over a business. These are extremely difficult situations for family. Professional guidance is essential to protect both the elder and the business itself. It can be done, but it will be with considerable work, often very uncomfortable in the process. Fear and discomfort must not stop the family from taking essential action.

Takeaways

If your family is connected to a business run by a person who is facing mental illness, start with the legal documents (”articles”) of incorporation that describe what steps to take in the event of a principal’s disability. Get independent legal advice from outside the corporation about your options.

Read the full article here