What’s it’s like to be retired when a recession hits?

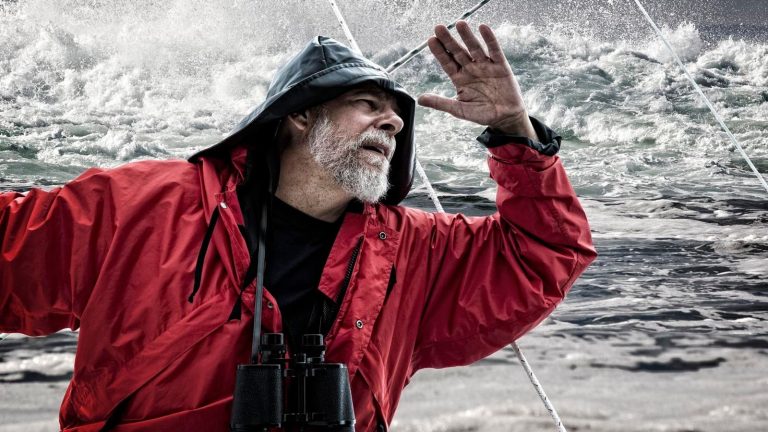

Every good ship’s captain knows how to ride out choppy waters. He’s got a tried-and-true rulebook. Maybe it’s not in writing. Maybe it’s just in his head. But he’s certain about Rule #1: See a storm on the horizon? Sail around it.

Sometimes, though, you just can’t help but take on the rough seas. Sure, a safe harbor would be nice, but you’re a skilled helmsman. You can brave what’s coming. Years of experience have conditioned you to calmly pilot your craft, no matter what turbulence throws at you.

If you’re retired, the question you’re pondering right now is, “Can I sail through a recession?”

Is a recession bad for retirees?

Retirement, recession or boom, poses a two-pronged challenge. You need stability now and you need gains later. And you must manage your assets to achieve both goals simultaneously. This is the traditional “growth and income” objective. It was one of the standard mutual fund classifications for many years before the Morningstar style box became the cat’s pajamas for every financial planner.

Growth and income is a form of financial multitasking. Doing more than one thing at the same time turns out to be good for retirees.

According to the Federal Reserve, “Among retirees who did not have labor income, those who had pensions or income from interest, dividends, or rents were doing better financially than those who were reliant solely on Social Security and cash transfers from other government programs or reported no income sources in 2023.” It suggests retirees who have multiple sources of income are in a better position to do “At least OK financially,” should a recession occur.

Despite this apparent confidence, there’s increasing interest among retirees for practical strategies amid economic uncertainty. In navigating the rolling waves of economic cycles, a suitable set of rules will help steady your voyage. It all begins with a solid foundation.

You can benefit from exploring what that means.

What not to invest in during a recession?

When you’re building the home you intend to live in for a long time, you pay close attention to make sure the mason you hire creates a rock-solid foundation. You don’t want the wind or rattling ground to knock your house off its perch.

The same concept applies to your retirement. Plan on spending maybe as much as a third of your life in retirement. For this, you need a rock-solid financial foundation. It’s not hard to determine how to measure what that means.

“It’s important to keep two years of expenses in risk-free savings vehicles like money markets because accounts like money markets are less volatile during a recession,” says Lisa Greene-Lewis, a tax expert with TurboTax in Ladera Ranch, California. “You can easily move money in and out of a money market and preserve your gains.”

Greene-Lewis’s two-year cash savings target isn’t just an arbitrary number. It represents how long it takes on average for stocks to recover from a recession. Using these cash funds to pay retirement expenses means you don’t have to sell stocks when prices are low. By avoiding these forced sales, you’re preserving your long-term growth potential.

Building up a robust emergency cash fund represents a critical first step towards recession-proofing your retirement portfolio. Cash is the cornerstone of financial stability in retirement. While it certainly provides immediate security during a recession, you can’t ignore your need for long-term growth.

What is the best recession-proof balanced portfolio for retirement?

Here’s something new to think about. Portfolio management textbooks have long advocated viewing asset allocation in terms of asset classes. For example, an aggressive portfolio might be “80/20” meaning 80% of it would be invested in stocks and 20% in bonds. Similarly, a conservative portfolio might be “40/60” with 40% in stocks and 60% in bonds.

In recent years, some feel assigning assets to specific risk buckets makes more sense.

“Most retirement planners today recommend a bucket strategy that separates retirement assets into three parts based on when you need the money,” says Neal K. Shah, CEO at CareYaya Health Technologies in Research Triangle Park, North Carolina. “These three buckets are: 1) Immediate Needs: Cash equivalents for up to 2 years of expenses that you can access anytime. 2) Medium Term: Very conservative fixed-income investments that allow for slow, steady growth with minimal risk. This part is designed to handle inflation and interest rate fluctuations that could affect market prices over the next 2-5 years. 3) Long-Term Growth: Equities that have a really good chance to grow a lot over the next 10-25 years (compared with other kinds of investments). The part handles inflation and interest variations that could affect prices over the next 5-10 years.”

Historical performance shows balanced portfolios—whether in percentage form or within the risk bucket construct—have recovered losses during recessions in adequate time. This strategy ensures both safety and growth potential.

Recession, lower interest rates, and retirement

One of the side benefits of a recession results when the need for capital decreases. As the economy slows, fewer businesses are looking for money to expand their operations. This decrease in demand leads to lower interest rates. You can benefit from lower interest rates when you’re retired.

“When recessions hit, they are typically followed by interest rate cuts to help get the economy back on track,” says Vince DeCrow, founder of RISE Investments in Chicago. “A lower interest rate environment can create home refinance opportunities to lower their monthly housing expense or make the long sought after vacation home purchase more economically feasible.”

Current predictions call for at least two rate cuts in 2025. This is the silver lining of any economic slowdown. This suggests lower inflation, which boosts the financial prospects of anyone on a fixed income. Moreover, this can significantly enhance retirees’ financial options.

Surprise gains in a recession for retirees

Like every storm wave is different, no two recessions are alike. Still, a good guide will provide general clues on how to mitigate any economic maelstrom. That guide comprises three things: maintaining a cash buffer for safety; investing in a balanced portfolio for endurance; and watching for rate cuts and lowering inflation for opportunities you didn’t expect.

You can manage through a recession. With the right mindset, you could even profit from it. And therein lies the surprise bonus rule: think outside the box. With steady hands and bold moves, recessions can offer unique opportunities to make more money.

Recall that those with multiple sources of revenue tend to keep an even keel during a recession. You might be retired from your career job, but that doesn’t mean you won’t discover a new way to bring in revenue. Such openings can make recessions a time for growth.

In a recession, wise retirees don’t just survive—they set sail for sunnier shores.

Read the full article here