Inflation unexpectedly slowed in March to its lowest rate since September, dropping to 2.4% year over year and over the last three months (February’s 2.8%, January’s 3%, and December’s 2.9%), according to data released on Thursday by the U.S. Bureau of Labor Statistics.

The consumer price index (CPI), which tracks the prices of goods and services, fell by 0.1% in March on a month-over-month basis. Core inflation, which measures increases in prices of core goods excluding food and energy, was 2.8% year-over-year in March, marking its slowest pace since March 2021.

Related: U.S. Businesses Added 155,000 New Jobs in March, According to ADP Data: ‘A Good One for the Economy’

“In a vacuum, this is the kind of inflation data the Fed wants to see, with notable cooldowns in some of the peskiest categories like housing and transportation services,” Elyse Ausenbaugh, head of investment strategy at J.P. Morgan Wealth Management, told Entrepreneur in an email.

However, Ausenbaugh notes that slower inflation doesn’t mean that the Federal Reserve will cut rates at the next Federal Open Market Committee meeting in May. While President Donald Trump has paused the increased tariffs for many countries for 90 days, there’s still a 10% tariff on all trading partners, and an “at least” 145% tariff on China that poses uncertainty for consumer prices.

“I expect them [the Federal Reserve] to stay humble and data-dependent,” Ausenbaugh stated.

Related: ‘Really Hard to Find a Job’: 1.7 Million Job Seekers Have Been Looking for Work for at Least 6 Months

EY Senior Economist Lydia Boussour told Entrepreneur in an email that higher tariffs could lead to higher inflation numbers down the road. She predicted that core CPI inflation would be in the 3.5% to 4% range by the end of the year, an increase of at least 0.7% from its level in March.

“We believe the Fed will eventually decide to ease policy, but a late response to growing economic weakness will exacerbate the slowdown and favor three rate cuts in the second half of the year as the economy slows,” Boussour said.

The CPI decline was led by a 6.3% monthly decrease in prices for gasoline and a 4.2% drop in fuel oil prices, which offset a 3.6% increase in natural gas prices, a 0.9% growth in electricity costs, and a 0.4% rise in apparel prices. Housing costs were up 0.2%, while transportation was down 1.4%, both less than February’s monthly changes.

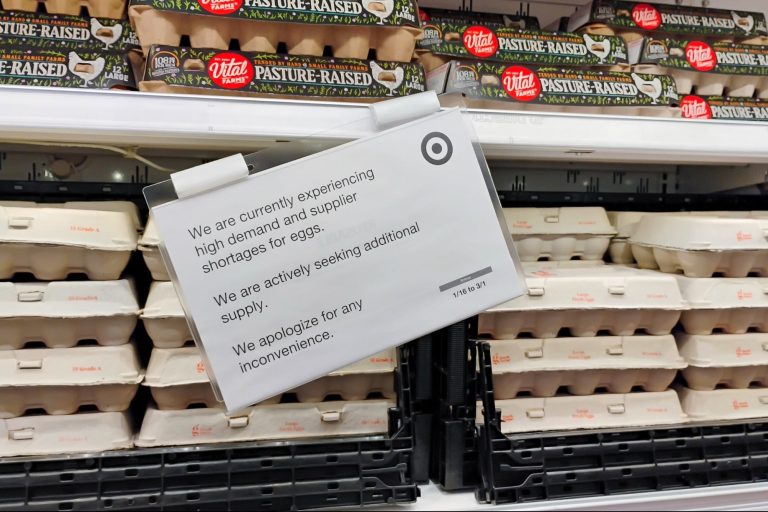

The food category rose 0.4% month-over-month in March after a 0.2% rise in February. The price of eggs, which went up by 5.9% from February to March, drove the bulk of the increase, but the index for meats, poultry, fish, and eggs also rose by 1.3%.

Read the full article here