It’s a hard time to look for work in America, and many Americans are looking. Over 45% of Americans earn extra money by working a side hustle. Most of the Americans who do work a side hustle work an extra 12-hours on top of their primary job. And even after all of that extra work, many Americans barely make half of their primary monthly income with a side hustle.

If you are making money from a side hustle, and want to save it for the long term, then try savings bonds.

Savings Bond

Are you looking for a good place to stash the savings you generate from a side hustle? Then a savings bond may be a good bet for you.

A savings bond is a U.S. government debt security. In other words, when you buy a savings bond you are loaning the American government money to run its operations.

And just like a traditional bond, a savings bond is virtually guaranteed to payout when needed. As long as the American government exists, your return on investment in a savings bond is highly likely to be repaid.

A savings bond is similar to a traditional Treasury bond as an investment vehicle but has several distinct differences.

Unlike a traditional Treasury bond, a savings bond only pays interest after it is redeemed.

A coupon rate refers to the interest rate that is credited against a bond over time. For example, a traditional Treasury bond is credited with interest twice a year. A savings bond gains incremental amounts of interest each month.

Unlike a Treasury bond, which pays out the interest that it accrues when you cash it out, a savings bond does not. You must wait about a year before you can cash out a savings bond.

And if you cash out a savings bond before a period of five years, then you lose the last three applicable months of interest.

Taxes on a savings bond are not paid until the bond is redeemed. Taxes are paid via interest payments with most traditional bonds. And taxes on savings bonds are paid only on a national level.

The biggest difference between a traditional bond and a savings bond is that a savings bond still exists after its maturity date.

Types of Savings Bonds

There are basically three kinds of savings bonds, however, only two still currently exist.

The Series E savings bonds were first created During World War II to help fund the war effort. Series E savings bonds were phased out of circulation in 1980 and are no longer issued.

Additionally, if you own a Series E savings bond, you can still cash them in, but they stopped gaining interest in 1980.

The Series EE savings bond were first circulated in 1980 and become the direct replacement for the Series E. Series EE savings bonds are still issued now.

Additionally, if you bought an electronic Series EE bond after June 2003, the U.S. Treasury guarantees that you can redeem it for twice its face value. And if you hold onto an electronic Series EE bond issued in June 2003 or afterward for at least 20 years, it will earn an annual interest rate of 3.5%.

The Series I savings bond offer an enhanced level of protection against inflation relative to the Series EE saving bond. And all Series I savings bonds offer a fixed rate or variable rate interest rate based on the Consumer Price Index.

You can buy savings bonds for any amount between $25 to $10,000 within a 12-month period.

And you can only cash in a savings bond once it is at least 12-months old. Also, if you cash in a savings bond before its five-year maturity, you will lose at least three months of interest.

The Series EE and Series I savings bond for a period of up to 30-years. If you are saving money from a side hustle, you can use a savings bond as a long-term strategy to keep it.

However, one major drawback of the savings bond is the interest rate.

Savings Bond Interest Rates (And other Drawbacks)

Savings bonds are a great way to save money that was hard-earned from a side hustle. However, the biggest major drawback of investing in savings bonds is that they generate minimal interest.

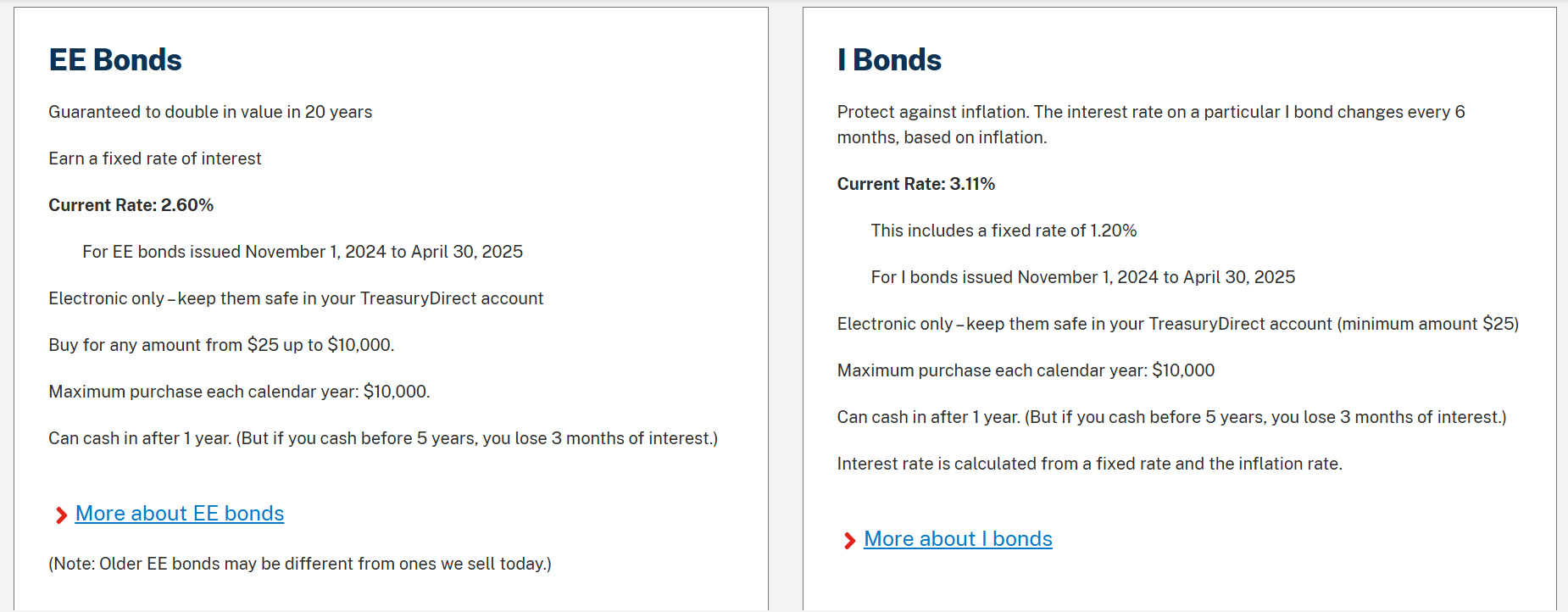

Currently, Series EE savings bonds only offer a 2.6% interest rate. And the Series I savings bond currently offers a 3.11% interest rate – however, that interest rate can vary according to the Consumer Price Index. Here are the current rates from the treasury.

You can get the latest rates here.

Savings bonds are inherently non-transferable, and you cannot sell them to others. If you buy an electronic Treasury bond, you can transfer it to another person’s account.

Still, if you have a long-term savings strategy in mind, saving money from a side hustle in a savings bond is a good way to go.

Side Hustle Strategy

Paper savings bonds can be cashed at banks, check-cashing centers, and other financial institutions. If you buy electronic savings bonds at TreasuryDirect.gov, then you can credit the money on your account and then transfer it to a bank account.

It isn’t easy to work a side hustle in this pandemic-wrecked economy, so consider every option possible to save more of the money you earn.

Read More

3 Ways to Make Money on Facebook

What Is the Minimum Wage In Denver, Colorado

Need Some Money Making Ideas? Here Are 38 You’ve Never Heard Of.

Read the full article here