I don’t know what I was expecting when I went to my first Rotary Club meeting, but it’s not what I found.

I suppose I’d deemed such groups as ineffectual, outdated, self-serving, and salesy. But when a friend invited me—a longtime Rotary veteran at the Roswell, Georgia Club who didn’t seem to exemplify any of those characteristics—I decided to give it a shot.

My first impression wasn’t necessarily bolstered as I parked my car outside of the municipal gymnasium, but as I opened the door, I was greeted by a buzz of positivity. The proceedings were, indeed, held in a space that seemed better suited for a middle school basketball tournament, but it was packed with around 250 men and women of various ages and ethnicities, and the one thing they seemed to have in common was that everyone wanted me, and several other visitors, to feel welcome.

Service Above Self

As the meeting came to order, the foremost core tenet was announced, and it began to shift my perspective: “Service above self,” they insisted, was the way of the Rotarian.

Apparently, the phrase was originally introduced conversationally at a Rotary convention in the early 1900s, and became one of two official mottos in 1950, joining “He Profits Most Who Serves Best.” Then, in 1989, “Service above self” became the principal motto because it best conveys the philosophy of unselfish volunteer service. And I felt it in the room. There was something different, something genuine, about this group.

This sense was amplified when I decided to get involved with the Roswell Rotary Club’s annual fundraiser a few weeks later. The idea—a day of golf, tennis, and pickleball—wasn’t particularly novel, but the outcome left my mouth agape when I heard that they raised more than $200,000 for local charities. Two hundred grand!

And although this was the largest event of the year, it seemed like there were events and opportunities for service at least weekly that always drew a crowd, whether it was doing cleanup on the Chattahoochee River, learning about the work being done to fight human trafficking in Atlanta, mentoring in local area high schools, filling provisioned backpacks for homeless veterans, or playing cornhole to promote the eradication of polio internationally—a cause to which Rotary International members have given more than $2.7 billion! (BTW, ask me who won the cornhole tournament.)

Four Guiding Questions

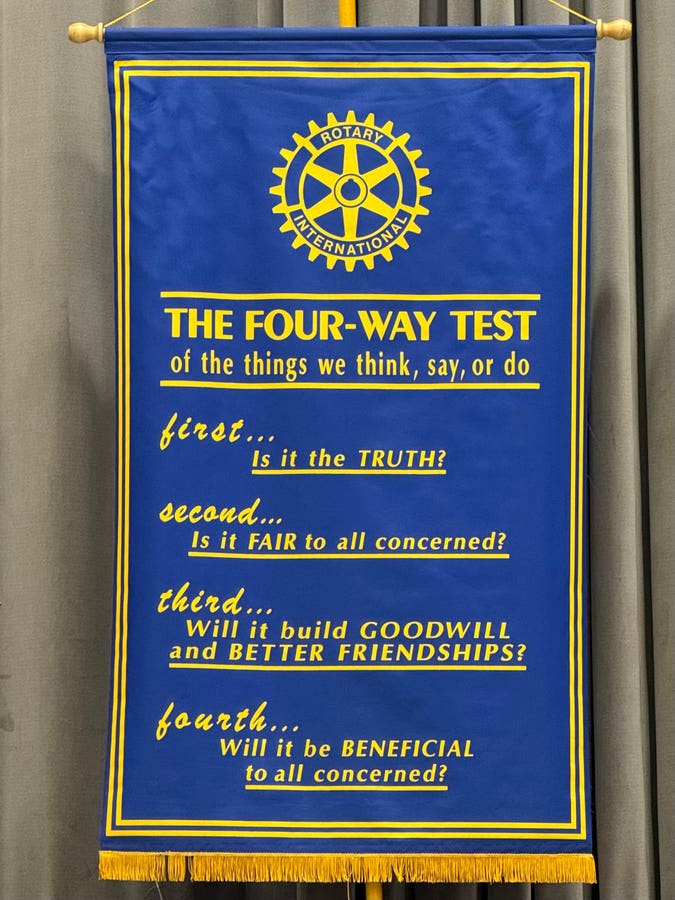

As if I needed further proof that these people were for real, every meeting is closed with a joint recitation of The Four-Way Test. Originally the brainchild of Rotarian Herbert J. Taylor, who used the Test to help turn around the Club Aluminum Products Company facing bankruptcy in 1932, Taylor gave Rotary the rights to use the test in 1942 and ultimately transferred the copyright. Here it is:

“The Four-Way Test of the things we think, say, or do

- First…is it the TRUTH?

- Second…is it FAIR to all concerned?

- Third…will it build GOODWILL and BETTER FRIENDSHIPS?

- Fourth…will it be BENEFICIAL to all concerned?”

Would you sit with that for a moment? Would you consider how many of the challenges we face today—in businesses, schools, communities, politics, and interpersonal relationships—could be muted if there was even the slightest attempt to adhere to this simple standard? And what if it actually became a societal rule, a central code?

Well, in Rotary, I’ve witnessed it—at least in the Roswell, Georgia Club. Despite the fact that everyone in the room comes from different personal, educational, religious, political, age, and racial backgrounds, it feels like a place where the labels are left at the door, even despite the fact that this civic group regularly invites an ecumenical spectrum of religious affiliates to lead the invocation each week and often features local, state, and even national politicians as speakers.

It also got me wondering: How can we apply this Four-Way Test in a smaller space, the space over which we have the most agency—our homes and families? And could we drill down even further, considering the very specific application of the Test in navigating one of, if not the most, explosive topics in our closest relationships—our money?

Money has a unique power in our relationships, as both a tool for flourishing and one of the most divisive forces. So how might The Four-Way Test be applied in this specific domain?

Application: The Four-Way (Financial) test

- Is it the TRUTH? How can we foster greater honesty in our financial conversations? What are we actually spending? Is that spending in alignment with our values? What are our very real financial fears? What are we hiding or avoiding? I realize this leads us into some very vulnerable territory, but genuine vulnerability is one of the key ingredients to lasting trust, and it’s the breakdown in trust that so regularly leads to financial strife and division in our households.

- Is it FAIR to all concerned? How do we foster fairness in financial decision-making? How can we create space for degrees of spending autonomy as well as standards for transparency? Most households tend to have one, not two, “financial spouses,” but how do we ensure that both have a financial voice in the relationship?

- Will it build GOODWILL and better friendships? Money conversations can either strengthen or erode trust and intimacy. One of the most powerful unifying traits to be employed in healthy money management is grace. Money management is really an exercise in mistake management, requiring constant calibration, and therefore developing our system with grace at its core and margin as its primary ingredient helps us build goodwill, rather than demonizing our partners for their financial missteps.

- Will it be BENEFICIAL to all concerned? Too often, family financial systems are built around the goals and values of the “financial spouse,” but it’s important that these systems serve the family’s shared values, not just individual wants. As a result, input from every person in the household, children included, typically results in the healthiest interaction around money.

In that gymnasium in Roswell, I was struck by something I hadn’t expected: a group of people from wildly different backgrounds who’d actually figured out how to operate from a shared ethical foundation. Not perfectly, not without friction, but genuinely. So, I’m pleased to report that, as of this week, I was one of three new members inducted into the club.

That same alchemy is possible in our homes. Money will always require hard conversations. It will always surface our fears and foibles, but also our values and priorities. And what if those conversations operated from the same framework Rotarians have used to move mountains together? Asking not “How do I win?” but “What serves us all?”

Service above self, when applied to the people we live with, means choosing honesty over convenience. It means sacrifice over dominance. It means building systems designed around shared flourishing, not individual control. It means extending grace to ourselves and each other as we learn and recalibrate.

That’s not naive idealism. That’s the hard, daily work of treating money as what it actually is: a tool for growing, protecting, living, and giving.

Read the full article here