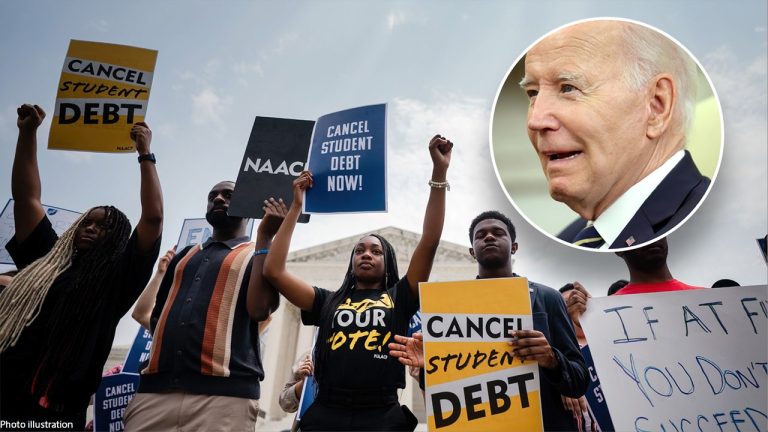

After finding legal loopholes around the Supreme Court’s student loan decision, one personal finance expert unveiled what the Biden administration isn’t broadcasting about its new repayment plan.

“They’re really pulling the wool over people’s eyes because they go, ‘oh, there’s forgiveness here, I don’t have to pay my loan,'” Jade Warshaw, “The Ramsey Show” co-host, said Wednesday on FOX Business’ “Mornings with Maria.” “But what they’re not saying is how many years it takes to actually get this forgiveness.”

President Biden announced the new student loan handout legislation — dubbed the Saving on a Valuable Education (SAVE) plan — which aims to cut monthly payments while following an income-driven outline.

Borrowers could see their monthly payments go to zero dollars, be cut in half, or those who do make payments may save up to $1,000 per year, the White House said in a statement.

BIDEN’S FAILED STUDENT LOANS FORGIVENESS LEAVES SOME BORROWERS SCRAMBLING: SURVEY

“If you have $12,000 of student loan debt, that’s the bar getting into this, and you’re going to have to pay for 10 years in order to see that forgiveness. And then for every additional thousand, you pay another year,” Warshaw explained.

“So the average person has about $30,000 of student loan debt,” she continued. “That’s 30 years they’re going to have to pay before they see this forgiveness at the end of the rainbow… it’s a bait and switch.”

Loan repayments were set to begin again in October after more than three years on hold amid the COVID pandemic. Warshaw pointed out how Biden’s revamped plan — which was struck down by the Supreme Court last month — discourages living debt-free.

“During this three-year pause, we only saw that about 1% of borrowers continued to make payments… we’ve seen the studies come back that the others who did not take that windfall, they spent it on other debt like cars, retail shopping. That’s what they spent the money on,” the “Ramsey Show” co-host said. “And we know that the average borrower got back about $15,000 in payments from not having to pay that debt.”

A recent analysis from the University of Pennsylvania’s Penn Wharton budget model showed that the SAVE plan will cost U.S. taxpayers $475 billion over 10 years.

The group further wrote that about $200 billion will come from payment reduction for outstanding loans in 2023 with 53% of the current loan volume moving to SAVE once it goes active in July 2024 — “implying that about $869 billion will be subject to enhanced subsidies under SAVE.”

According to Warshaw, the president is “doing what he does best” with this new student loan handout plan, “offering bribes for votes.”

“What they’re not saying is how many years it takes to actually get this forgiveness.”

“The bottom line is you signed for the debt. You’ve got to pay the debt, and you can do that. I want people to be organized about knowing these payments are coming back. I want them to get on a budget to make sure they can make the payment,” the finance expert said.

“And ultimately,” Warshaw added, “I want their plan of attack to be to pay these off and stop passing it off to taxpayers who are single moms, truck drivers, people who never even took out student loans or having to fit the bill for this forgiveness.”

The U.S. Department of Education did not immediately respond to Fox News Digital’s request for comment.

Prior to joining the Ramsey Solutions team, Warshaw worked to climb out of $280,000 in student loan and consumer debt. Using the same steps she did, Warshaw argues most people can pay off their debt and save three to six months of expenses over three years.

“You start with saving $1,000 just to have that quick safety net. Then you list all of your debts from smallest to largest. You make minimum payments on everything but put the extra money on the smallest debt. It’s called a snowball. You can roll through that debt very quickly,” she explained.

READ MORE FROM FOX BUSINESS

FOX Business’ Anders Hagstrom contributed to this report.

Read the full article here