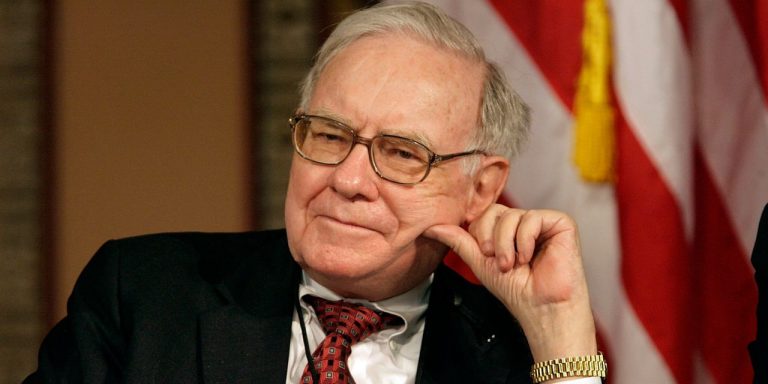

Warren Buffett’s Berkshire Hathaway swung to a profit in the second quarter owed to its investment portfolio and insurance holdings, according to a release out Saturday.

The holding company with businesses that range from insurer Geico and railroad BNSF Railway to Dairy Queen restaurants and its own energy division posted net income of $35.9 billion, or $24,775 a class A share equivalent. That compared with a loss of $43.8 billion, or $29,754 a class A share equivalent, a year earlier.

Berkshire’s

BRK.A,

BRK.B,

after-tax operating earnings, a figure Warren Buffett wants shareholders to and which excludes some investment results, rose 6% to just over $10 billion from $9.3 billion a year earlier. Regulations do require Berkshire to include unrealized gains and losses from its investment portfolio when it reports its net income.

Berkshire’s stock repurchases totaled $1.4 billion in the second quarter, compared with $4.4 billion in the first quarter and $1 billion for the year-earlier period. The Q2 repurchases were below an estimate of $2.2 billion from UBS analyst Brian Meredith.

Reduced buybacks did come alongside appreciation in Berkshire stock, which was up 10% in the second quarter.

Berkshire ended the second quarter with $147.4 billion in cash and cash equivalents, compared with $105.4 billion in the same period a year ago.

Berkshire’s Class A shares have been hovering near all-time highs, up 21% over the past year and bringing the company’s market value to roughly $780 billion.

Read the full article here