In my last column (Wanted Ice Cream Scoopers – $23/hr – Yes, The Service Economy Is Booming (forbes.com)), I thought it was difficult to imagine a recession before year end. So, I posited that the SP 500 might even challenge its August 2022 high of 4300. Beep Beep! The roadrunner stock market took 4300 as a minor speed bump to last week’s 4600 high. Why so strong? And is a potential recession just another wall of worry to climb?

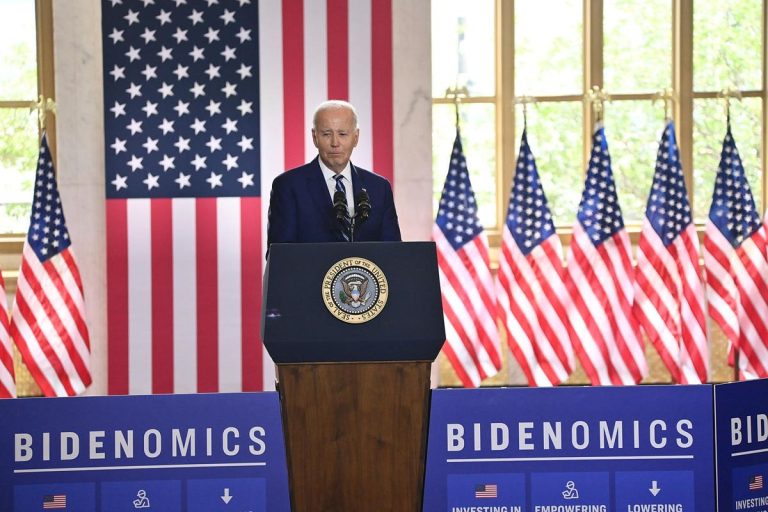

First, I should note that the bond market and the stock market are in complete disagreement on the future macroeconomic path. Stocks clearly see blue skies while the bond market, with its severely inverted yield curve, predicts heartache for the economy around the next bend. Both could be befuddled by Bidenomics. This is not either party’s political talking point on the President’s economics but rather my view of the most unique thing happening entirely due to DC. Since 1950, we have never had a moment where DC ran a massive federal budget deficit while the economy simultaneously was at or below full employment. This is a combo of reduced tax revenue, the Inflation Reduction Act, the Infrastructure bill, and all the other DC mislabeled bills. Profligate deficit spending while in an economic boom is truly an n of 1 event and looks like something called “fiscal dominance”. As per the St. Louis Fed, the definition of fiscal dominance is, “Central banks’ resolve and independence is chronically tested by fiscal authorities wishing to impose their desired policies.”

Currently DC is running an 8.5% federal budget deficit while unemployment sits at 3.5% (almost the lowest in history). Warren Pies, macro analyst extraordinaire at 3Fourteen Research, calculates that at that level of unemployment the best guess for a fiscal deficit based on history since 1950, would be 1%. So, this massive deficit is the unique driving power behind Bidenomics and the stock market loves it.

So far, massive fiscal largesse has been enough to overcome the Fed and its rapid 525 basis point increase in short interest rates. Could this have been the master plan? That probably gives a lot of credit to disconnected institutions in DC like Congress, the Administration, and the Fed. More likely, it looks like a serendipitous balance leading many equity buyers to dream of a ‘soft landing” and a Fed pivot to lower rates. Is it sustainable? Are there any risks?

The sustainability of this bifurcated policy is tough because someone must buy the bonds to fund the deficit. It is a lot of paper (think trillions with a T) and the Fed is no longer a buyer while foreigners seem more than skittish. So, look around the room, because we the people and our banks are the only buyers left. Banks have that funding problem in that it is tough to pay depositors 5% to buy 4% bonds. Now, that leaves just you and me. For me, 4% long bonds look good only if we are entering recession. If Bidenomics is the new norm, we may need for the bond market to incent buyers through higher term premiums (amount paid to bond investors for extending credit for a long time). Since 1960, the average term premium, per the Fed, has been around 1.5%. Today, that figure is -0.8%. So, not a prediction, but wouldn’t a 6-7% long-bond be more tempting? This is a major risk with continued massive budget deficits. Until we see that happen, there is no reason to go long duration and best to sit in T-bills providing 5% + yields with liquidity until we see any movement.

The other risk is a currency swoon of the dollar. Usually, countries creating this much fiscal, trade, and current account deficit do not sport healthy currencies. We are the reserve currency, but we are testing those limits with Bidenomics. In every column, I advocate having as much gold/silver as you can tolerate (no reason to go beyond 25% of your portfolio). Gold will protect wealth against currency swoons and diversify a stock/bond portfolio regally (RIP Harry Markowitz).

Stocks? Hang in there, buy serious dips (5-10%) and be very data dependent on unemployment claims, especially the continuing claims. Once those start to move up significantly versus where they were pre-pandemic, the recession may be arriving. If so, a new phase of the economy will be upon us. I will worry about that then. Enjoy the rest of the summer!!

Read the full article here