Two think tanks are urging a federal court to block the Biden administration’s scaled-back plan to cancel $39 billion in student loans, arguing that the plan exceeds the administration’s authority.

The lawsuit was filed Friday in Michigan by the New Civil Liberties Alliance on behalf of free market think tank Mackinac Center for Public Policy and libertarian think tank the Cato Institute.

The groups accused the administration of overstepping its power in announcing student loan debt relief for 800,000 borrowers worth $39 billion – a plan the Department of Education rolled out shortly after the Supreme Court struck down a broader student loan handout plan pushed by President Biden.

Friday’s lawsuit requested for a judge to rule the latest debt forgiveness plan as illegal and to block the Department of Education from carrying it out until the case is decided.

BIDEN ADMINISTRATION FORGIVES $39 BILLION IN STUDENT LOAN DEBT TO MORE THAN 800,000 BORROWERS

The Department of Education claimed in a statement that the suit is “a desperate attempt from right wing special interests to keep hundreds of thousands of borrowers in debt,” adding that the department will not “back down or give an inch when it comes to defending working families.”

The challenge comes after several legal complaints Republicans have made to halt the Biden administration’s proposals to reduce or eliminate student debt for millions of borrowers. The president has said he will pursue another way to cancel student debt after the Supreme Court shot his plan down in June.

The administration is separately pushing a more generous repayment plan that opponents have described as a “backdoor attempt” to cancel loans.

SUPREME COURT RULES AGAINST BIDEN STUDENT LOAN DEBT HANDOUT

The administration announced a plan on July 14 to forgive loans for 804,000 borrowers enrolled in income-driven repayment plans, which have long offered cancellation after 20 or 25 years of payments, but “past administrative failures” led to inaccurate payment counts setting borrowers back on their progress toward forgiveness, according to the department.

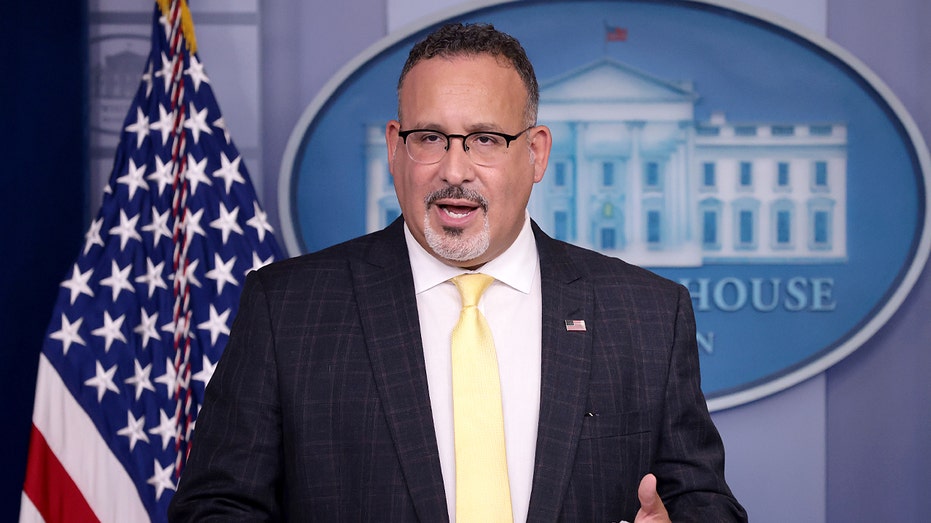

“For far too long, borrowers fell through the cracks of a broken system that failed to keep accurate track of their progress towards forgiveness … By fixing past administrative failures, we are ensuring everyone gets the forgiveness they deserve, just as we have done for public servants, students who were cheated by their colleges, and borrowers with permanent disabilities, including veterans. This Administration will not stop fighting to level the playing field in higher education,” Secretary of Education Miguel Cardona said in a statement announcing the administration’s new plan.

The new plan was announced as a “one-time adjustment” that would count certain periods of past nonpayment as if borrowers had been making payments during that time. The action moved 804,000 borrowers across the mark of 20 or 25 years needed for cancellation and pushed millions of others closer to that threshold.

According to the department, the plan is intended to address a practice known as forbearance steering, where student loan servicers hired by the government pushed borrowers to go into forbearance, a temporary pause on payments due to hardship, even if they would have been better off enrolling in an income-driven repayment plan.

STUDENT LOAN BORROWERS TOOK ON NEW DEBT DURING PAYMENT PAUSE: REPORT

Past periods in forbearance under the one-time fix were also counted as progress toward Public Service Loan Forgiveness, a program offering cancellation after 10 years of payments while working in a government or nonprofit job.

The lawsuit accused Biden’s plan of undercutting the Public Service Loan Forgiveness program, which the Mackinac Center and Cato Institute say they use to employ borrowers who are working toward student loan cancellation. The groups argued Biden’s action illegally accelerates progress toward relief, which diminishes the benefit for nonprofit employers.

“This unlawful reduction in the PSLF service requirement injures public service employers that rely on PSLF to recruit and retain college-educated employees,” the lawsuit stated.

The Cato Institute previously sued the Biden administration over the student debt cancellation plan that the Supreme Court struck down, and the Mackinac Center is separately challenging Biden’s pause on student loan payments, which is scheduled to end this fall as payments resume in October.

The Associated Press contributed to this report.

Read the full article here