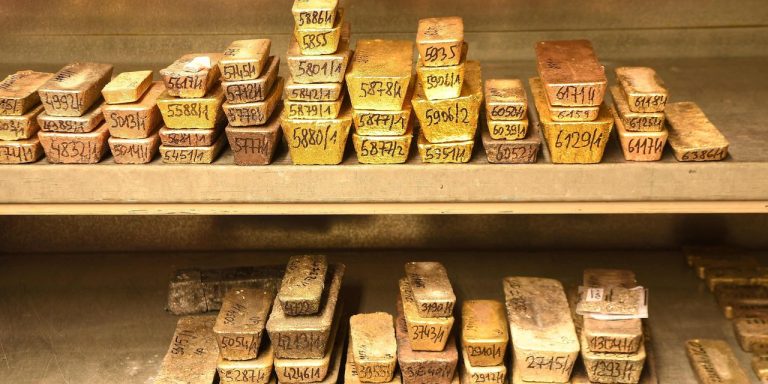

The most-active gold futures contract settled higher on Friday, snapping its three-day losing streak after the July jobs report showed the U.S. economy gained just 187,000 jobs last month, slightly below the Dow Jones estimate of 200,000 and pointing to a still-solid hiring in the labor market.

Price action

-

Gold futures for December delivery

GC00,

-0.29% GCZ23,

-0.29%

rose $7.30, or 0.4%, to settle at $1,976.10 per ounce on Comex, with prices down nearly 1.2% for the week, according to Dow Jones Market Data. -

Silver futures for September delivery

SI00,

-1.50% SIU23,

-1.50%

gained 2 cents, or 0.1%, to end at $23.72 per ounce, posting a weekly decline of 3.2%. -

Palladium futures for September

PA00,

-2.26%

PAU23,

-2.26%

advanced $7.20, or 0.6%, to finish at $1,264.60 per ounce, rising 2% for the week, while platinum futures for October

PL00,

-0.23% PLV23,

-0.23%

was up $6.70, or 0.7%, to settle at $928.50 per ounce and booked a weekly decline of 1.6%. -

Copper futures for September

HG00,

-0.59% HGU23,

-0.59%

fell by 3 cents, or 0.8%, ending at $3.87 per pound. For the week, the copper lost 1.5%, according to Dow Jones Market Data.

Market drivers

Gold prices settled higher on Friday, reversing the previous three consecutive sessions of losses after the latest report from the Bureau of Labor Statistics showed the U.S. economy gained just 187,000 jobs in July, another indication that the labor market is slowly cooling off and perhaps a welcome sign as the financial markets are still debating whether the Federal Reserve will get interest-rate hikes out of the way by the end of this year.

The unemployment rate, meanwhile, fell to 3.5% in July from 3.6% in the previous month, the government said Friday.

However, wages, a closely watched indicator of how much leverage workers are exerting in the labor market, increased 0.4% in July, stronger than the Fed would like. The increase over the past 12 months was unchanged at 4.4%.

See: U.S. adds 187,000 jobs in July and points to hiring slowdown. But wages still high

“Below consensus job growth, combined with higher average hourly earnings signals that more progress is needed to reduce the jobs-workers gap, slow wage growth, and ultimately lower inflation,” said Candice Tse, global head of strategic advisory solutions at Goldman Sachs. “The Fed has likely ended its most aggressive tightening campaign in generations, with a reasonable path to a soft landing.”

However, there is still “a wide range of possible outcomes,” with risks tilted towards additional hikes should inflation remain sticky, though not her base case, she said in emailed comments on Friday.

The weaker-than-expected U.S. jobs report pushed the U.S. dollar and Treasury yields lower, offering some respite to the yellow metal which slid for three straight sessions, after Fitch Ratings’ decision to cut the U.S. government’s credit rating tumbled the financial markets.

The ICE U.S. Dollar Index

DXY,

a closely watched gauge of the dollar’s value against other major currencies, dropped by 0.6% at 101.93 on Friday afternoon.

Treasury yields pulled back from near 10-month highs with the yield on the 10-year Treasury note

BX:TMUBMUSD10Y

off 12 basis points, at 4.068%, while the yield on the 30-year Treasury bond

BX:TMUBMUSD30Y

declined by 9 basis points, at 4.216% on Friday, according to FactSet data.

Read the full article here