Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

Rates for well-qualified borrowers using the Credible marketplace to refinance student loans decreased this week for 5-year variable-rate loans and increased for 10-year fixed-rate loans.

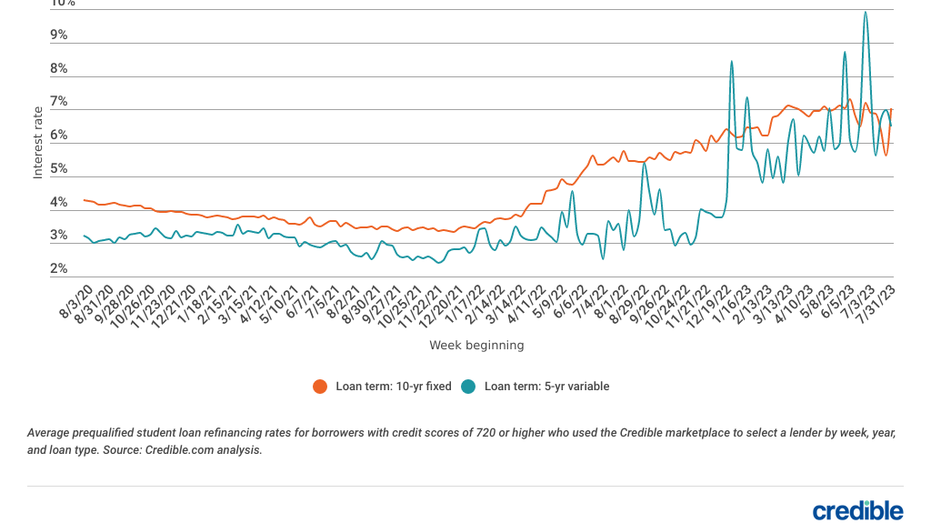

For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender the week of July 31, 2023:

- Rates on 10-year fixed-rate refinance loans averaged 7.04%, up from 5.63% the week before and up from 5.43% a year ago. Rates for this term hit their lowest point of 2022 during the week of Jan. 10, when they were at 3.44%.

- Rates on 5-year variable-rate refinance loans averaged 6.48%, down from 6.99% the week before and up from 3.58% a year ago. Rates for this term hit their lowest point of 2022 during the week of July 4, when they were at 2.51%.

Student loan refinancing weekly rate trends

If you’re curious about what kind of student loan refinance rates you may qualify for, you can use an online tool like Credible to compare options from different private lenders.

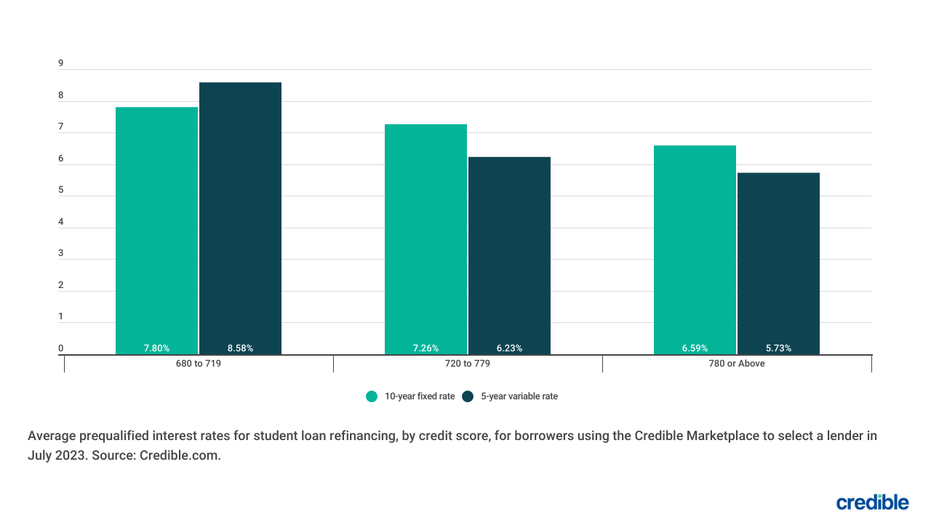

Current student loan refinancing rates by FICO score

To provide relief from the economic impacts of the COVID-19 pandemic, interest and payments on federal student loans have been suspended since March 2020. However, interest will begin accruing again on Sept. 1, 2023, with payments resuming in October. But many borrowers with private student loans are taking advantage of the low interest rate environment to refinance their education debt at lower rates.

If you qualify to refinance your student loans, the interest rate you may be offered can depend on factors like your FICO score, the type of loan you’re seeking (fixed or variable rate) and the loan repayment term.

The chart above shows that good credit can help you get a lower rate and that rates tend to be higher on loans with fixed interest rates and longer repayment terms. Because each lender has its own method of evaluating borrowers, it’s a good idea to request rates from multiple lenders so you can compare your options. A student loan refinancing calculator can help you estimate how much you might save.

If you want to refinance with bad credit, you may need to apply with a cosigner. Or, you can work on improving your credit before applying. Many lenders will allow children to refinance parent PLUS loans in their own name after graduation.

You can use Credible to compare rates from multiple private lenders at once without affecting your credit score.

How rates for student loan refinancing are determined

The rates private lenders charge to refinance student loans depend in part on the economy and interest rate environment, but also the loan term, the type of loan (fixed- or variable-rate), the borrower’s creditworthiness and the lender’s operating costs and profit margin.

About Credible

Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly compare accurate, personalized loan options – without putting their personal information at risk or affecting their credit score. The Credible marketplace provides an unrivaled customer experience, as reflected by over 5,000+ positive Trustpilot reviews and a TrustScore of 4.7/5.

Read the full article here